- The BitMEX co-founder offloaded HYPE price roughly $5.1M over the weekend.

- Newest information reveals he spent $374,999 USDC to build up 1,630 AAVE tokens.

- The transfer may point out renewed consideration on prime DeFi belongings.

Crypto traders and merchants are repositioning amid prevailing broader bearishness.

BitMEX’s ex-CEO and co-founder, Arthur Hayes, continues to regulate his portfolio.

Hayes lowered his publicity over the weekend by promoting 96,628 HYPE cash, price about $5.1 million.

Hayes has redeployed his proceeds right this moment. Lookonchain highlighted that the billionaire spent $374,999 USDC to purchase 1,630 AAVE tokens a couple of hours in the past.

Arthur Hayes(@CryptoHayes) simply spent 374,999 $USDC to purchase 1,630 $AAVE at $230. etherscan.io/tackle/0x6cd6…

5:40 PM · Sep 23, 2025

The transaction has gained consideration from cryptocurrency analysts and merchants, with many digesting the explanations behind the swap.

Whale actions are important in gauging broader market sentiments.

AAVE has turned bullish after the revelation, up over 3% on its day by day timeframe to commerce at $275 throughout this publication.

Shifting from hypothesis to stability

Hype has seen important volatility in current weeks, gaining traction because of its spectacular rallies.

It broke key resistance with substantial surges from $42 early this month to an all-time excessive of $58 on September 18.

The outstanding run prompted analysts to forecast huge rallies for the asset.

Hayes even forecasted a 126x surge for HYPE, citing Hyperliquid’s potential to dethrone Binance.

Nonetheless, the BitMEX co-founder exited his place after a month.

He emphasised looming token unlocks that would amplify promoting strain with the Hyperliquid ecosystem within the coming months.

In the meantime, switching to AAVE presumably displays Hayes’ new strategy to align with blue-chip DeFi protocols.

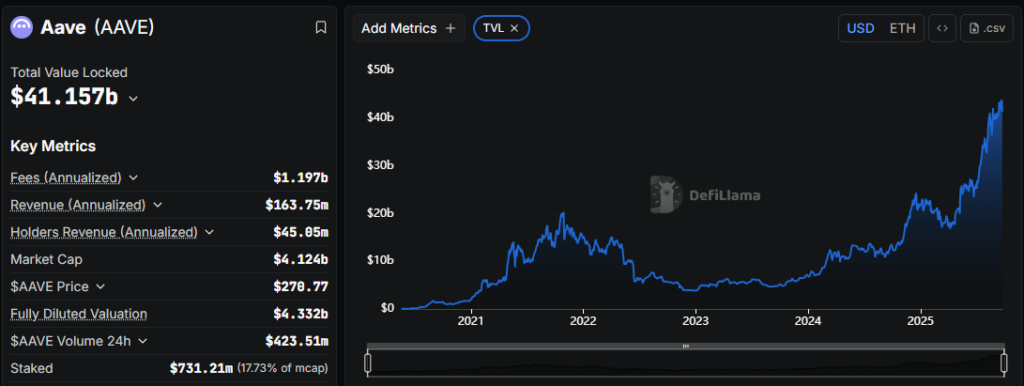

AAVE is a number one borrowing and lending platform, boasting over $41 billion in complete worth locked (TVL).

The blockchain even built-in Ripple’s compliant RLUSD stablecoin to make sure streamlined choices.

AAVE worth flips bullish

Whereas the buildup could possibly be small in comparison with the altcoin’s buying and selling quantity, Hayes’ buy renewed sentiments in AAVE.

The transaction indicated urge for food for DeFi blue chips. Aave is exchanging palms at $275, up 3.06% on the day by day timeframe.

Whereas Hayes’ buy doesn’t assure prolonged worth progress, it would act as a reference for different Whales planning related reallocations.

Alternatively, HYPE maintained a bearish bias right this moment.

Hyperliquid’s native token has misplaced almost 4% previously 24 hours to hover at $47.41.

Dwindled sentiments after Hayes’ contractions and dump contribute to Hyperliquid’s downsides.

Additional, the DEX faces intense competitors as Binance’s Aster (ASTER) beneficial properties unmatched momentum to democratize the derivatives market.

In the meantime, Hayes’s transactions remind us of the hazards of following influencers when investing in cryptocurrencies.

Most people probably invested in HYPE after the billionaire’s bullish wager.

Nonetheless, the BitMEX co-founder exited his place inside a month, leaving holders confused concerning the alt’s future efficiency.

Was he selling HYPE to his followers earlier than utilizing them as exit liquidity?

The very best factor is researching earlier than venturing into any digital token.