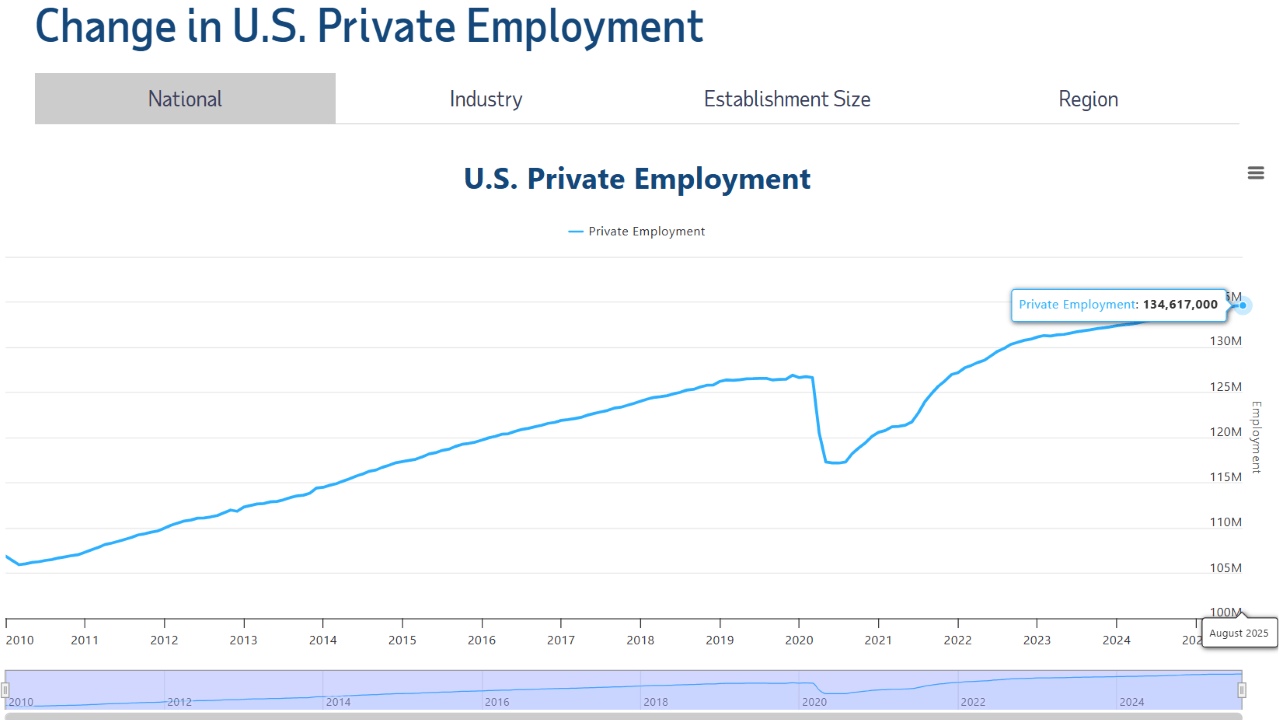

The rise in personal sector jobs for August was considerably decrease than what many economists had forecasted.

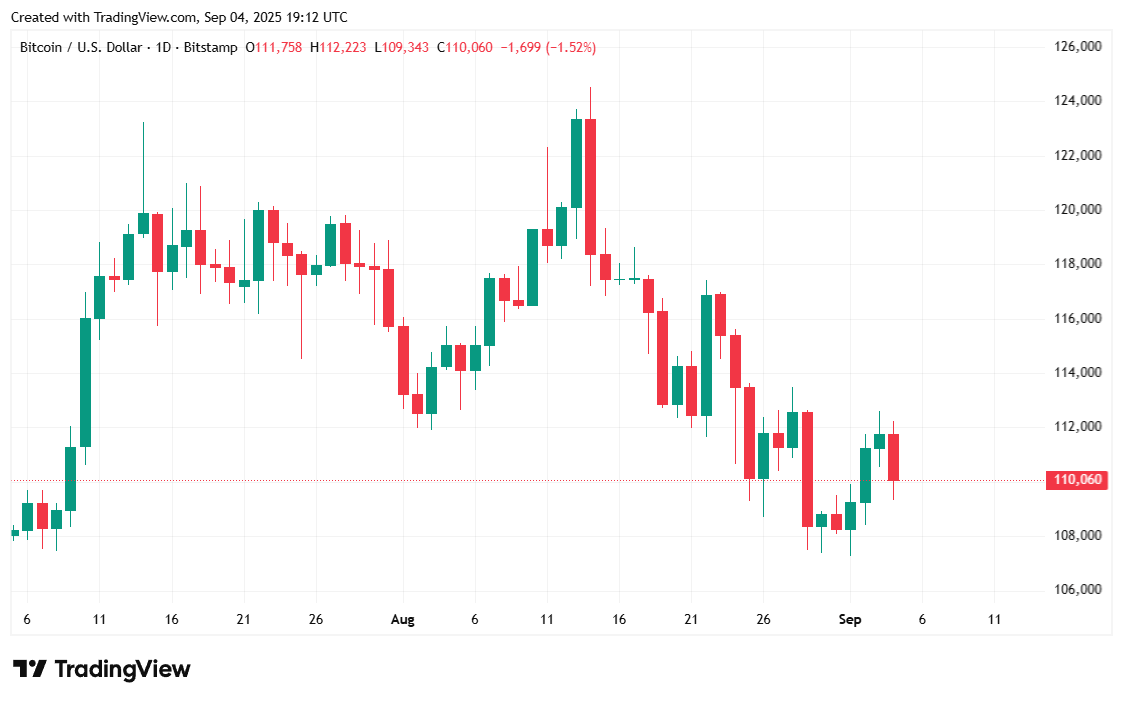

Disappointing Non-public Sector Jobs Knowledge Triggers BTC Slide Beneath $110K

New Jersey-based human assets agency ADP reported a rise of 54,000 personal sector U.S. jobs on Thursday, however that quantity is nicely beneath the 75,000 jobs economists have been anticipating. The inventory market appeared unbothered by the information, maybe ready as a substitute for the Federal authorities’s jobs report on Friday, however bitcoin took successful, tumbling by greater than 2%.

Industries akin to manufacturing, trades, schooling, well being, and even finance noticed the biggest cuts, shedding a mixed 38,000 roles. Others, akin to leisure and hospitality, fared a lot better, gaining 50,000 positions, with areas akin to development {and professional} companies additionally reporting job will increase.

(Thursday’s ADP personal sector jobs report confirmed a 54,000 enhance in U.S. personal employment, a lot decrease than the anticipated 75,000 job enhance / adp.com)

However with weekly jobless claims additionally leaping 8,000 to succeed in 237,000 for the week ending August 30, the best degree since June, and job openings reducing to their lowest ranges since September 2024, ADP’s newest report is another blow to what’s more and more wanting like a dismal outlook for the broader U.S. job market and maybe for bitcoin too, at the least within the quick time period.

“The 12 months began with robust job development, however that momentum has been whipsawed by uncertainty,” stated Dr. Nela Richardson, ADP’s chief economist. “Quite a lot of issues may clarify the hiring slowdown, together with labor shortages, skittish shoppers, and AI disruptions.”

Overview of Market Metrics

Bitcoin was buying and selling at $110,122.90 on the time of reporting, down 1.59% for the day and in addition down 2.25% over the previous week. Knowledge from Coinmarketcap exhibits the cryptocurrency has been buying and selling between $109,347.23 and $112,297.39 within the final 24 hours.

( BTC value / Buying and selling View)

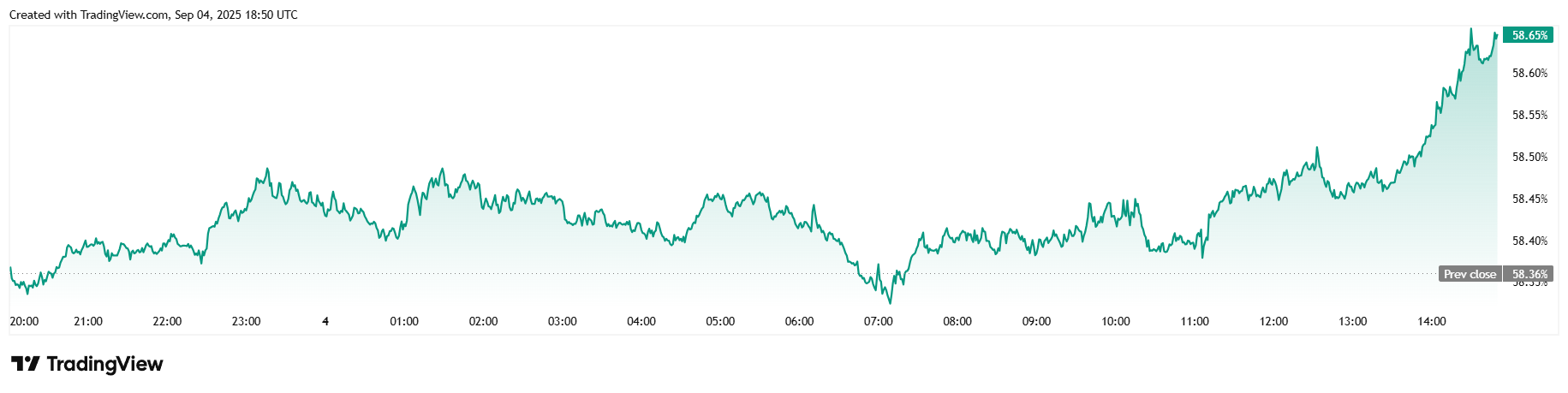

Buying and selling quantity for the day was down 8.77% on the time of writing, coming in at $57.75 billion. Market capitalization was additionally down by 1.55% at $2.19 trillion, however bitcoin dominance inched up 0.48% to 58.65%.

( BTC dominance / Buying and selling View)

Whole bitcoin futures open curiosity fell 1.53% to $79.95 billion over 24 hours, and Coinglass confirmed bitcoin liquidations reaching a grand whole of $42.85 million. Most of that determine was lengthy liquidations, which stood at $38.80 million, with shorts making up the remaining $4.05 million.