Bitcoin (BTC) could have peaked sooner than anticipated this cycle if historical past is any information, in accordance with new analysis by CoinGecko.

In an Aug. 28 report, CoinGecko analysts stated that after hitting a brand new all-time excessive of $124,128 in mid-August, BTC was lined up with the historic common time it has taken to succeed in an ATH post-halving up to now three cycles. If this newest ATH seems to be the cycle high, it will imply Bitcoin’s value peaked 68 days sooner than its 2021 excessive of $69,044.

Bitcoin’s halvings vs days until cycle ATH. Supply: CoinGecko

Traditionally, Bitcoin’s ATHs have come 12 to 18 months after halvings. In response to CoinGecko information, the primary post-halving ATH in 2013 got here 368 days after the November 2012 halving, rising from $12 to $1,127. The subsequent two cycles took longer: the 2017 ATH got here 525 days post-halving at $19,665, and the 2021 peak at $69,044 arrived 549 days after that newest halving.

Nonetheless, the 2025 cycle has set a brand new precedent. For the primary time since 2012, Bitcoin hit a pre-halving ATH, reaching $73,581 on March 14, 2024, after a two-month rally fueled by the approval of U.S. spot Bitcoin ETFs.

“The front-loaded demand resulted in a break in cycle sample, which can probably counteract the development of lengthening cycles and point out a basic market shift,” CoinGecko’s analysts wrote.

Bitcoin in Correction

The market continues to be shaky, in accordance with CryptoQuant’s head of analysis Julio Moreno, who informed The Defiant that the present value motion appears to be like extra like a correction slightly than the signal of a high.

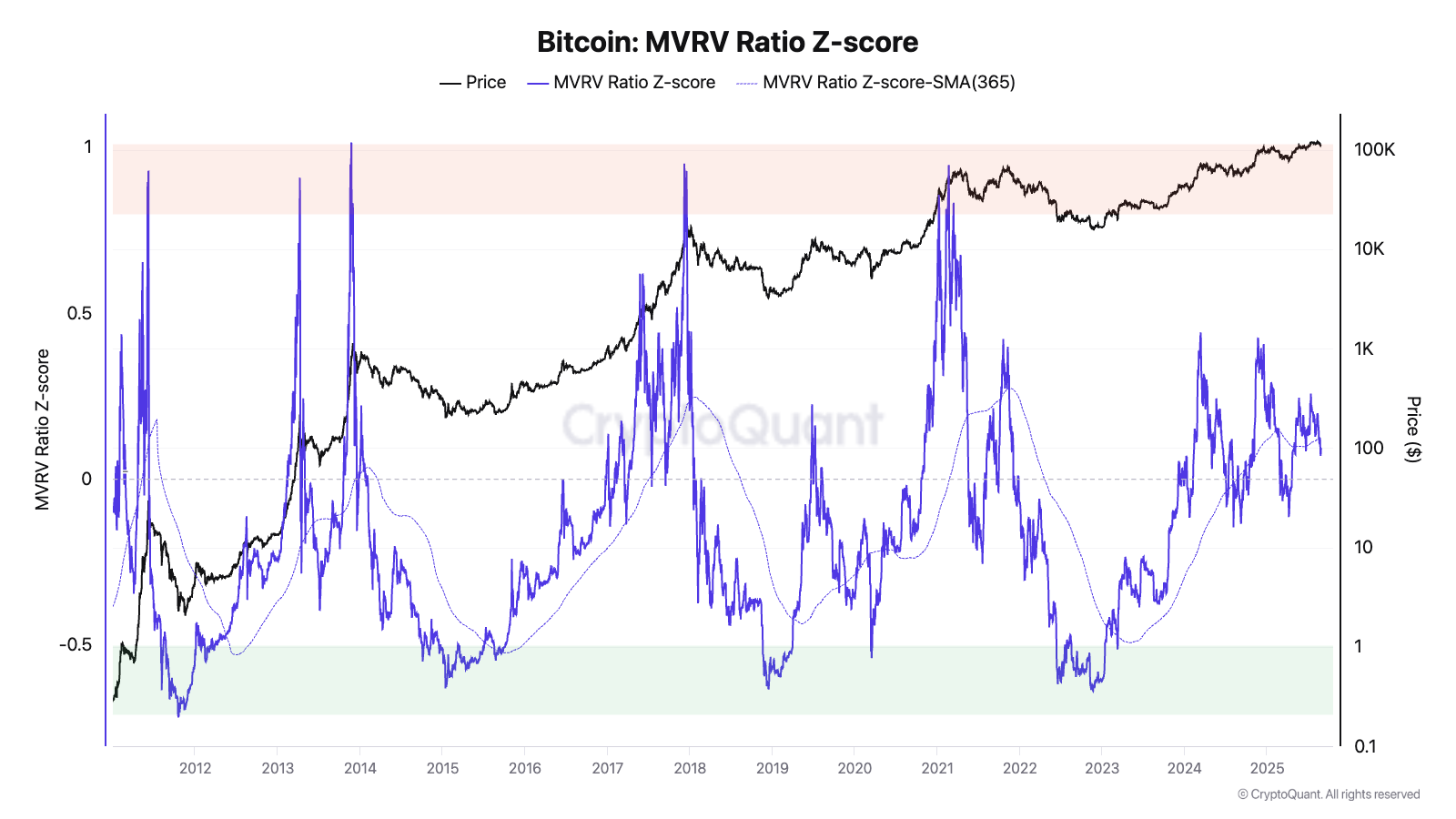

“Though it is troublesome to pinpoint when a cycle high has been reached, particularly so close to to the earlier all-time excessive, the indications we observe nonetheless counsel present value motion is a correction, and never a high. MVRV Ratio Z-score has not flagged an excessive overvaluation for Bitcoin (purple space within the first chart), however signifies a scarcity of optimistic value momentum (MVRV beneath its 365-day transferring common),” Moreno informed The Defiant.

Bitcoin’s MVRV z-score ratio. Supply: CryptoQuant

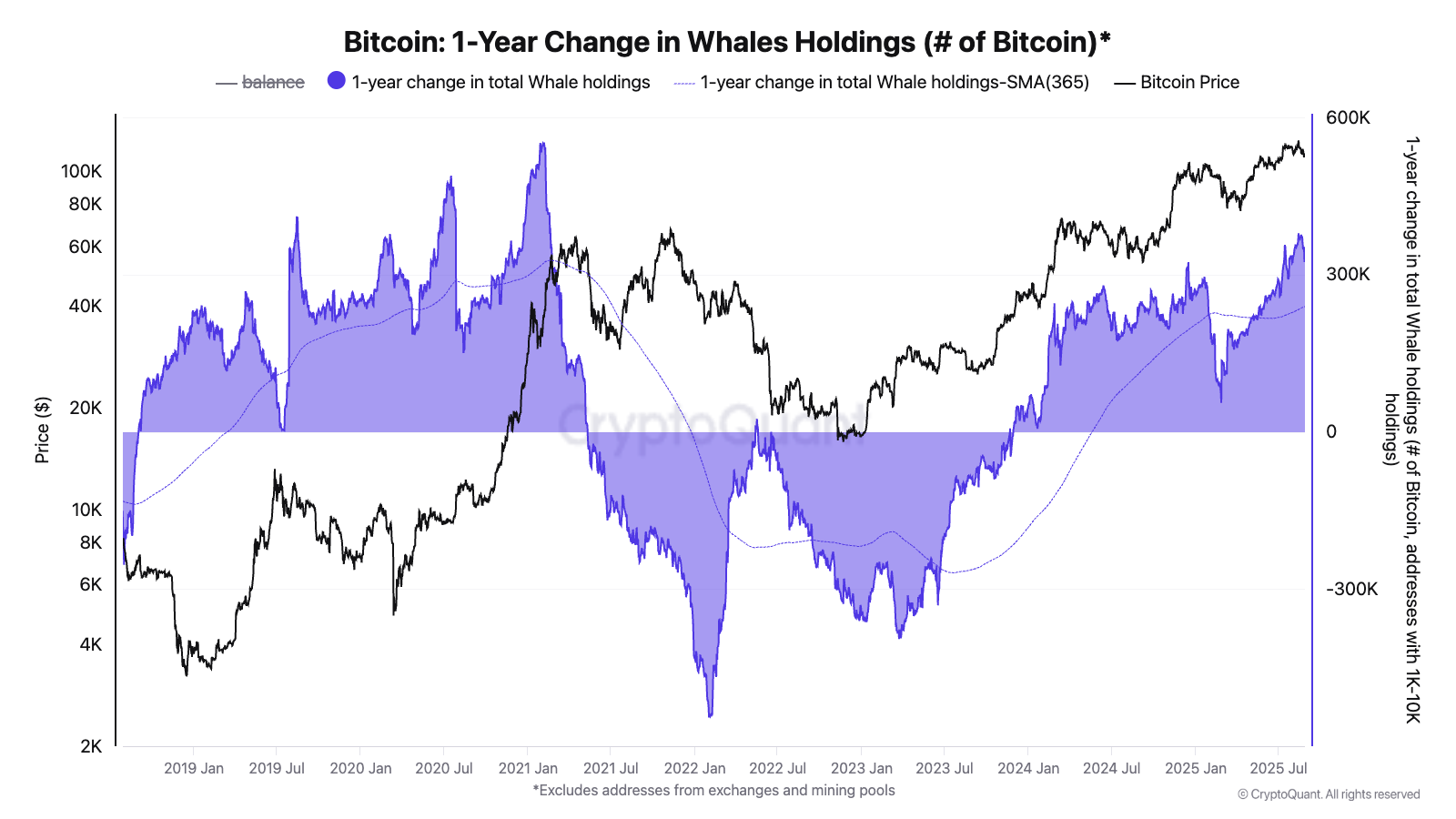

Talking with The Defiant, Moreno added that Bitcoin whale holdings are “nonetheless rising and above their 365-day transferring common,” which signifies that the bull market “continues as demand continues to be increasing (second chart).” But, Moreno admitted that bearish sentiment “is dominating proper now.”

BTC 1-year change in whale holdings. Supply: CryptoQuant

Ruan Chow, co-founder and CEO of Bitcoin DeFi platform Solv Protocol informed The Defiant that Bitcoin’s runway might be prolonged into This autumn ought to there be coverage easing or greenback liquidity enchancment. Nonetheless, with out this backing, the August peak “could stand as this cycle’s excessive.”

CoinGecko’s report notes that if the most recent ATH isn’t the cycle peak, Bitcoin may hit a ultimate cycle excessive someday between late September and late October, relying on components just like the upcoming U.S. Fed charge determination.

In response to Morgan Stanley, markets see a greater than 80% probability of a Fed charge reduce in September, although the percentages could also be nearer to 50-50 given robust financial indicators, like GDP development and low market volatility.

Are Halving Cycles Over?

In late July, separate analyses from CryptoQuant and Bitwise executives recommended that Bitcoin’s four-year cycle — the concept its value predictably rises after every halving earlier than crashing and recovering — is perhaps dropping relevance.

CryptoQuant CEO Ki Younger Ju famous that whereas massive holders used to promote to retail close to peaks, now whales are passing cash to different long-term holders, weakening conventional cycle patterns.

Bitwise CIO Matt Hougan, in his flip, defined that the forces behind previous cycles “are weaker” now as halving impacts fade and long-term developments like institutional adoption, ETFs, and regulatory progress play an even bigger position.