Bitcoin BTC$112,634.03 fell beneath $111,000 in the course of the in a single day commerce, reversing Friday’s spike brought on by Fed Chair Powell’s dovish speech, as a whale bought into illiquid market situations.

The cryptocurrency’s value fell by over 2% from $114,666 to $112,546 in beneath ten minutes to 07:40 UTC. The so-called flash crash occurred when a single whale bought 24,000 BTC, price over $300 million, in response to blockchain knowledge agency Timechainindex.com.

“This entity liquidated their total 24,000 steadiness, sending all of it to Hyperunite. They transferred 12,000 simply at the moment and are nonetheless actively promoting, which is probably going contributing to the continuing value drop,” the agency’s researcher Sani stated on X, including that the whale nonetheless holds a complete of 152,874 BTC throughout all related addresses, together with 5,266 BTC.

“The funds initially got here from HTX about six years in the past and had remained inactive till latest transactions involving considered one of their addresses containing roughly 24,000 BTC,” Sani famous.

Costs finally hit lows beneath $111,000 earlier than recovering to commerce close to $112,800 as of writing, in response to CoinDesk knowledge.

Powel spike reversed

The worth drop has erased positive aspects seen after Friday, after the Fed Chair Jerome Powell appeared to help the thought of price cuts, whereas enjoying down the long-term inflationary influence of President Trump’s tariffs throughout his annual speech at Jackson Gap.

The so-called dovish speech noticed BTC rally practically 4% from $112,500 to $116,900 alongside a risk-on rally in U.S. shares and the decline within the greenback index.

Over the weekend, the analyst group expressed confidence {that a} price reduce would happen in September, probably resulting in new all-time highs in bitcoin and ether.

Choices disagree

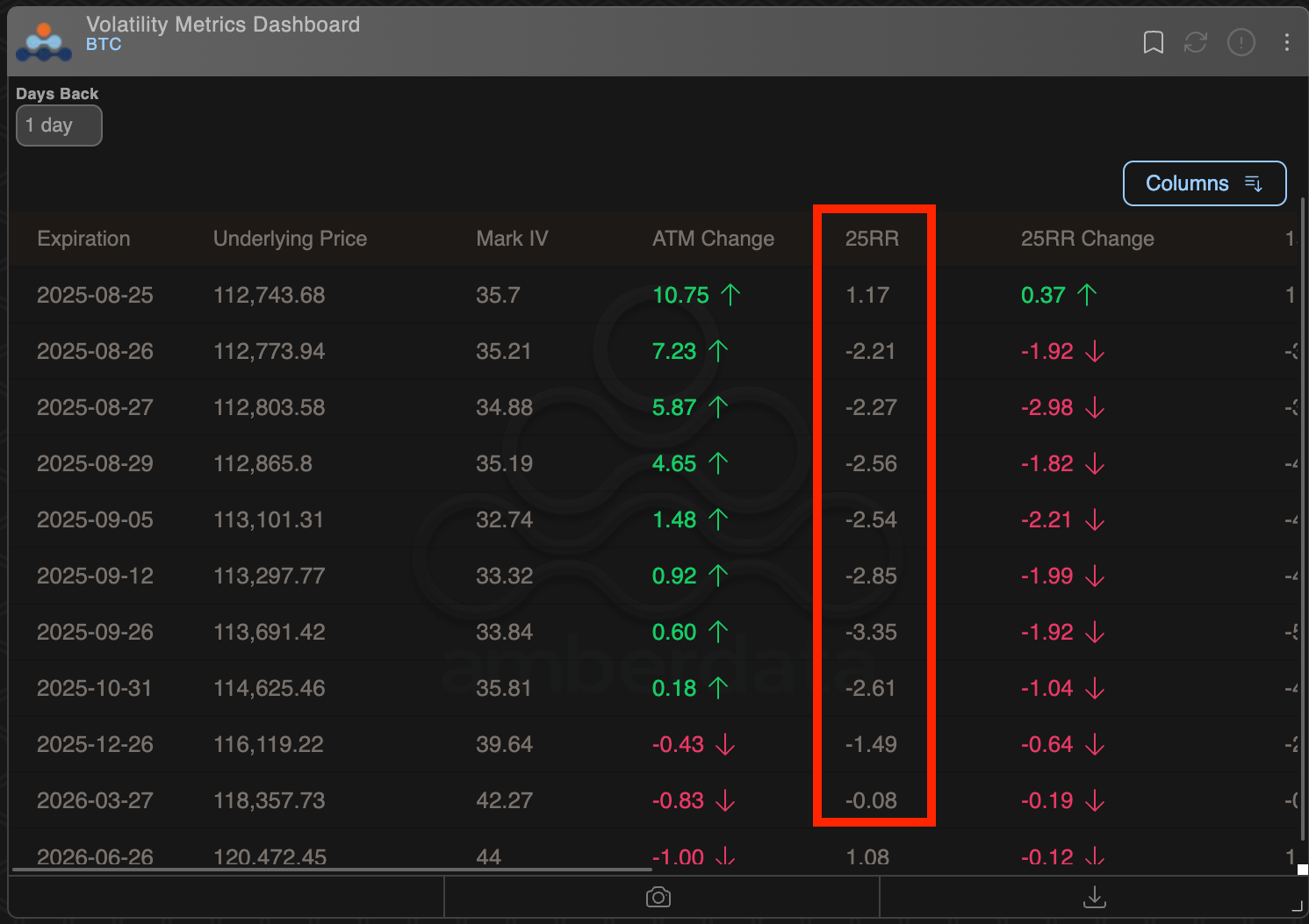

The Deribit-listed bitcoin choices reveal a lingering danger aversion, in response to knowledge tracked by Amberdata.

Particularly, the 25-delta danger reversals, a measure of investor sentiment evaluating calls to places, proceed to commerce within the unfavorable territory by means of the December expiry, reflecting hedging exercise and a bearish title.

A unfavorable danger reversal implies that put choices, which supply insurance coverage towards value declines, are costlier than name choices.

In different phrases, regardless of the so-called dovish pivot by Powell, BTC choices merchants proceed to cost in uncertainty, bracing for a possible draw back volatility.

BTC’s danger reversals. (Amberdata/Deribit)

Learn extra: Asia Morning Briefing: Bitcoin’s ETFs Kill the Transaction Charges, Punishing the Miners Extra