Bitcoin has continued its upward momentum over the previous week, reclaiming worth ranges near its all-time excessive. On the time of writing, the cryptocurrency is buying and selling above $120,000, solely a brief distance from the document of greater than $123,000.

During the last seven days, the asset has posted a acquire of roughly 5.1%, putting it among the many stronger performers within the digital asset market.

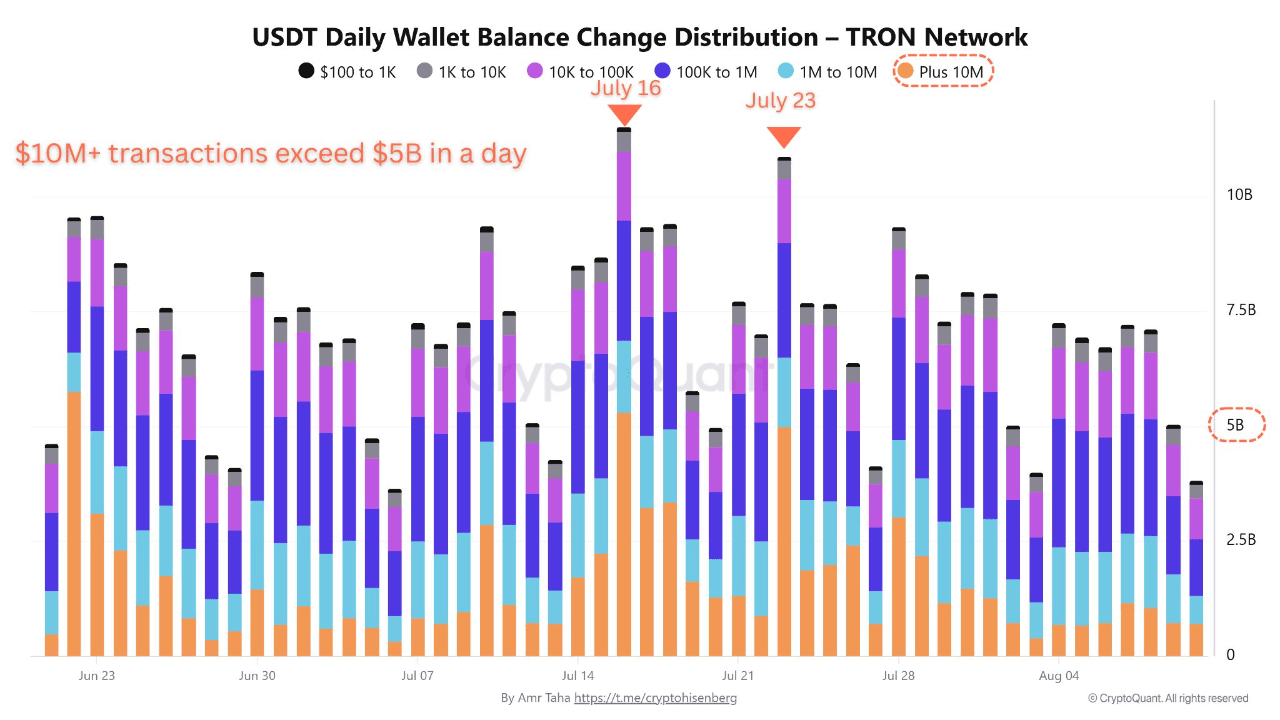

Amid the worth motion, on-chain knowledge from the TRON community’s USDT transfers is providing insights into present market conduct. CryptoQuant contributor Amr Taha analyzed TRC-20 USDT transaction flows and recognized patterns that will function potential indicators of Bitcoin worth shifts.

By categorizing transactions into six dimension teams, starting from retail trades of $100 to massive “tremendous whale” transfers exceeding $10 million, the evaluation goals to tell apart between on a regular basis market exercise and institutional-scale transactions.

Massive USDT Transfers as a Market Sign

Taha’s analysis notes that when transactions exceeding $10 million in USDT on the TRON community surpass $5 billion in a single day, this typically coincides with vital profit-taking in Bitcoin.

Such exercise usually entails changing BTC into USDT, adopted by transferring the stablecoins to non-public wallets, decreasing shopping for strain within the spot market.

Previous examples embrace July 16, when $10M+ USDT transfers reached $5.2 billion, adopted by a 4.5% decline in BTC, and July 23, when $5.8 billion in related transfers preceded a 3.8% drop inside 48 hours.

Present knowledge, nonetheless, reveals a scarcity of such large-scale transactions, suggesting that main holders should not actively promoting into stablecoins at current. This absence of considerable whale outflows might point out that giant traders are sustaining positions quite than exiting the market.

Bitcoin Shifting Market Participation and Potential Breakout Situations

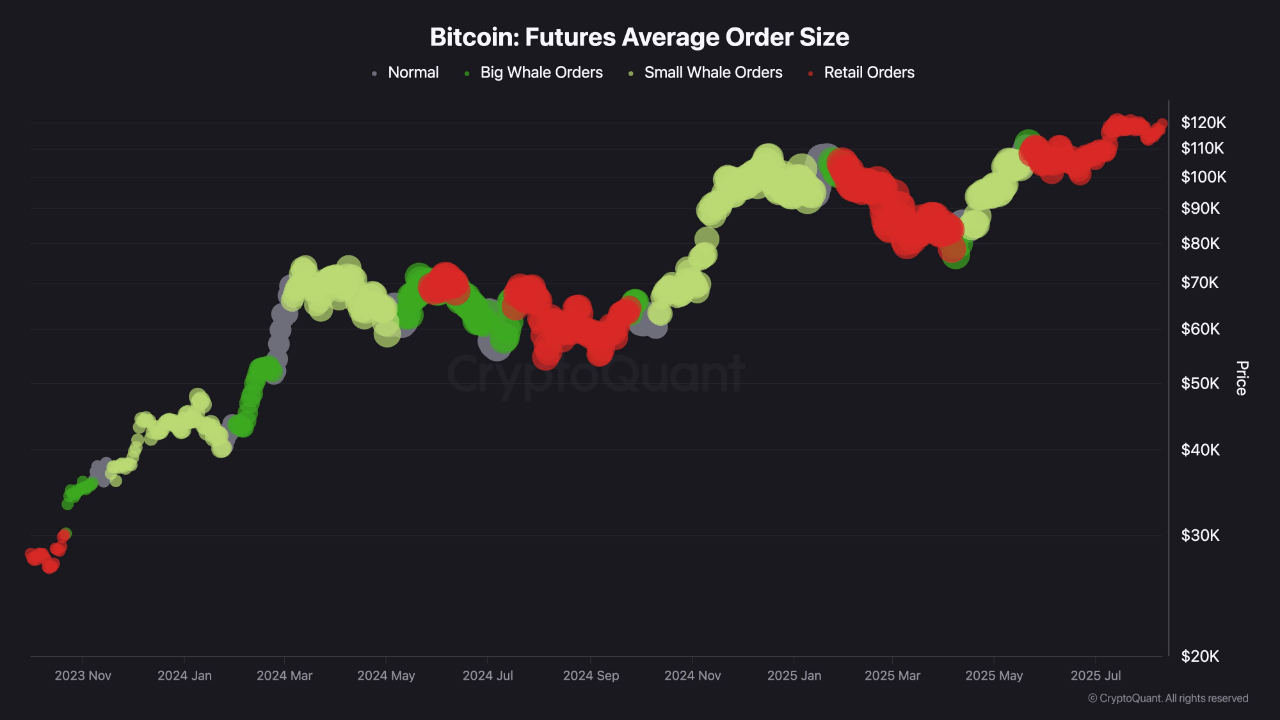

A separate evaluation from CryptoQuant’s ShayanMarkets examined the typical executed order dimension in Bitcoin futures markets, offering one other perspective on participation traits.

This metric, which divides complete traded quantity by the variety of executed orders, helps determine whether or not exercise is being pushed by retail individuals or bigger, institutional merchants.

Information from late 2024 and early 2025 confirmed durations of whale dominance, which coincided with sturdy rallies. In distinction, latest weeks have seen an increase in smaller, retail-sized orders, whereas whale-driven trades have diminished.

This shift means that large-scale patrons could also be holding positions acquired at lower cost ranges or ready for brand new market circumstances earlier than re-entering with vital quantity.

Traditionally, prolonged whale dominance close to market highs has typically been related to distribution phases, the place massive holders take income.

The present absence of such conduct leaves open the opportunity of a bullish breakout above Bitcoin’s earlier all-time excessive, supplied that renewed promoting strain from massive traders doesn’t emerge within the close to time period.

Featured picture created with DALL-E, Chart from TradingView