A historic worth comparability between Bitcoin (BTC) and gold means that the cryptocurrency may rally by 35% within the fourth quarter.

Notably, evaluation by Ted Pillows initiatives a significant upward transfer for Bitcoin, suggesting the digital asset may mirror gold’s historic breakout sample. If the analogy holds, BTC might commerce above $160,000 by This autumn, he mentioned in an X submit on July 26.

The comparability attracts on evaluation of gold and Bitcoin’s market habits, figuring out phases of accumulation, distribution, and re-accumulation earlier than every asset entered a robust rally.

Notably, gold’s rally, from beneath $2,000 to over $3,300, adopted a protracted re-accumulation section. In response to Pillows, Bitcoin seems to be nearing the tip of the same construction.

The analyst recommended Bitcoin’s market cycle is at the moment transitioning from re-accumulation to a rally section. This remaining leg may considerably push the cryptocurrency’s worth increased, probably exceeding $160,000 earlier than year-end.

It’s value noting that in 2025, gold has delivered a standout efficiency as buyers turned to the valuable steel for its safe-haven enchantment amid rising considerations over a possible financial downturn.

There’s certainly potential for Bitcoin to succeed in these ranges, particularly as some analysts argue that holding key technical indicators will likely be essential to its success. As an illustration, as reported by Finbold, crypto buying and selling professional Ali Martinez famous that so long as Bitcoin holds above the $110,000 spot stage, there may be room to succeed in a brand new all-time excessive at $130,000.

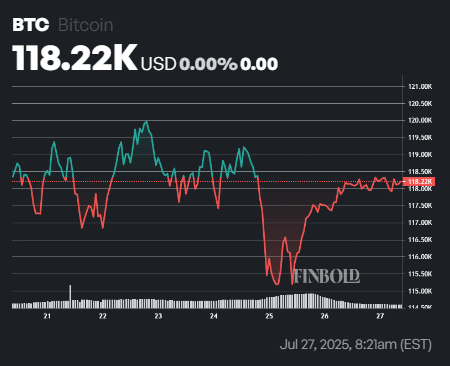

Bitcoin worth evaluation

As of press time, Bitcoin was valued at $118,216, posting modest positive aspects of lower than 0.1% prior to now 24 hours. During the last seven days, nevertheless, BTC is down 0.45%.

In the meantime, Bitcoin’s technical construction stays bullish, with the 50-day easy shifting common (SMA) at $110,580 and the 200-day SMA at $90,392, each pointing upward as the present worth exceeds them.

The 14-day Relative Power Index (RSI) stands at 60.43, indicating that the market is approaching overbought situations however has not but reached them.

Featured picture through Shutterstock