Bitcoin has entered a sideways corrective part, with buyers taking earnings and rotating capital into the altcoin market. As BTC cools off, the stage could also be set for a possible altcoin rally within the coming days.

Technical Evaluation

By ShayanMarkets

The Every day Chart

After going through robust resistance on the $123K degree, Bitcoin has entered a corrective part, seemingly pushed by profit-taking and distribution amongst buyers. Traditionally, when BTC cools down at its all-time excessive costs, capital typically rotates into altcoins, sparking rallies throughout the broader market.

Presently, a pullback towards the important thing 0.5–0.618 Fibonacci retracement zone, positioned between $107K and $111K, seems seemingly earlier than the following main bullish impulse. Till then, a interval of consolidation is anticipated, probably accompanied by notable energy in altcoins.

The 4-Hour Chart

On the decrease timeframe, Bitcoin’s consolidation is forming a descending wedge sample, a construction that usually indicators bullish continuation. The value is now approaching an important help zone between $113K and $116K, aligning with the 0.5–0.618 Fibonacci retracement ranges.

If this zone efficiently holds and triggers a breakout above the wedge, a transfer again towards the $123K resistance turns into seemingly. Nevertheless, if help fails, a deeper correction towards the $111K degree might unfold.

On-chain Evaluation

By ShayanMarkets

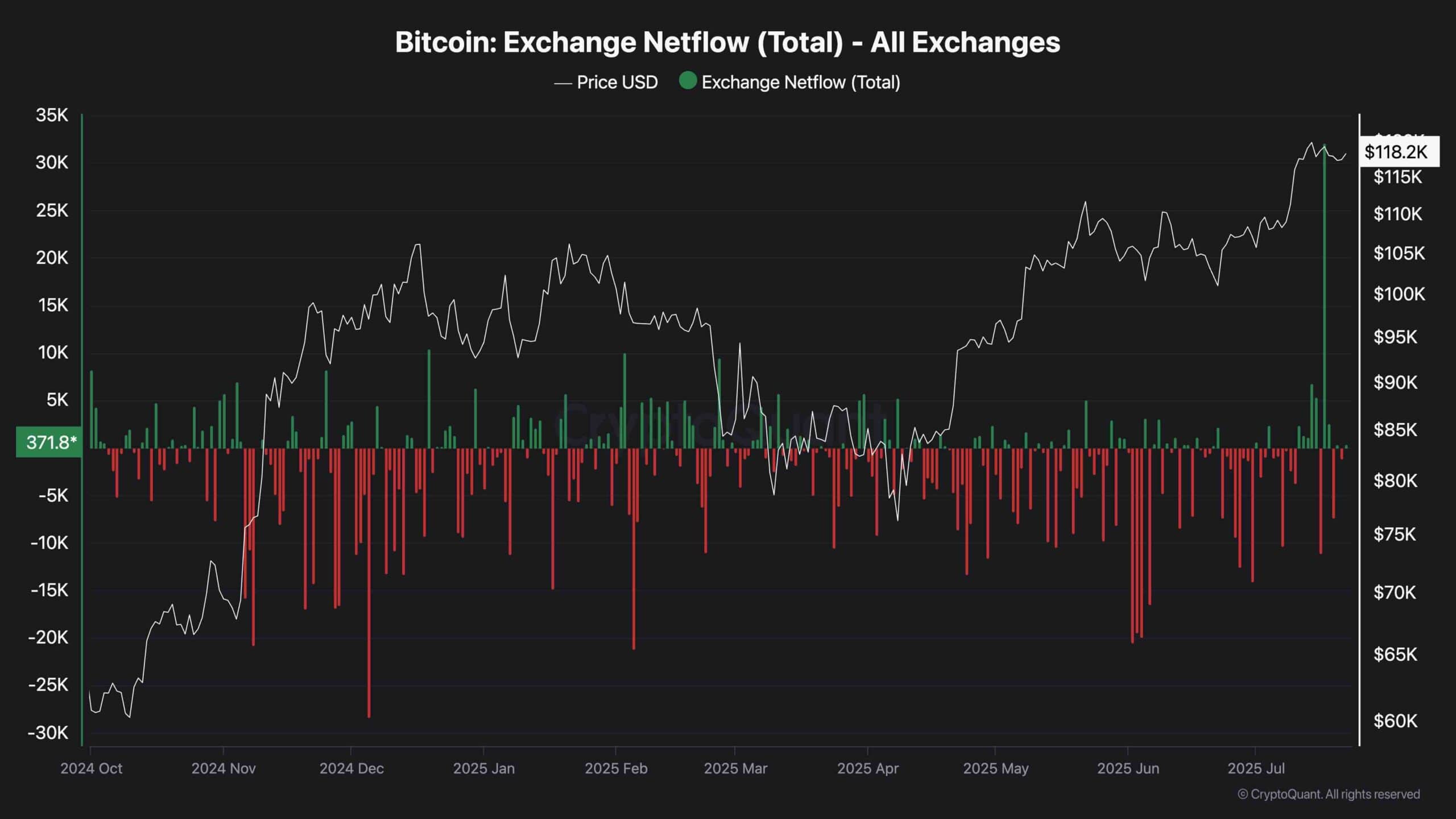

Bitcoin has seen its largest internet influx to exchanges since July 2024, marking a key shift in on-chain dynamics. Such inflows recommend elevated distribution and profit-taking, as extra BTC turns into accessible for buying and selling.

Traditionally, comparable change influx spikes have typically preceded deeper corrections. This week’s knowledge hints that main gamers, probably funds or establishments, are offloading BTC close to all-time highs, managing their threat publicity.

Nevertheless, this capital rotation may additionally gas an altcoin rally, with demand flowing into various belongings. As change provide rises, market volatility might enhance, particularly throughout demand surges. Merchants ought to maintain an in depth eye on this metric, because it may foreshadow the following main transfer.