Ethereum has lastly made a decisive transfer after weeks of sideways consolidation, breaking above vital resistance and buying and selling above the psychological $3,000 stage. This surge has caught the eye of each spot consumers and derivatives merchants, pushing ETH right into a key technical and on-chain inflection level.

The breakout coincides with heightened market curiosity, however the sustainability of this transfer now will depend on how the worth reacts to main provide zones within the coming days.

Technical Evaluation

By ShayanMarkets

The Every day Chart

On the day by day timeframe, ETH convincingly broke above the $2,800 resistance stage, sweeping earlier highs and reclaiming territory that was final traded again in early 2025. The 100-day and 200-day shifting averages at the moment are nicely under the worth, positioned close to the $2,300 and $2,500 marks, respectively.

This gives a powerful pattern affirmation and dynamic assist going ahead. The latest breakout additionally invalidated the prior liquidity hunt close to $2,900, suggesting real shopping for strain reasonably than only a stop-run. A clear day by day shut above $3,000 strengthens the bullish case even additional.

That mentioned, the worth is now pushing towards a broader resistance block at $3,400. If the consumers need to preserve momentum, a retest of the $2,800 zone wants to carry as new assist. Failure to carry this stage may result in a correction towards the 200-day shifting common. Till then, momentum favors the upside.

The 4-Hour Chart

Zooming into the 4H chart, ETH has proven robust impulsive construction, forsaking a number of imbalances and honest worth gaps because it pushed by means of the $2,800 resistance zone. This transfer additionally cleared the prior buy-side liquidity zone, validating a bullish market construction shift. The present leg up has created a rising imbalance, which may act as a magnet for a short-term pullback if consumers begin taking earnings.

The perfect state of affairs for continuation can be a managed retracement into the $2,850–$2,900 vary, forming a better low and confirming that demand remains to be in management. If the pullback will get deeper, the honest worth hole positioned on the $2,700 zone gives one other layer of assist. So long as the worth stays above this zone and maintains greater lows, the bullish market construction stays intact.

Sentiment Evaluation

Ethereum Open Curiosity

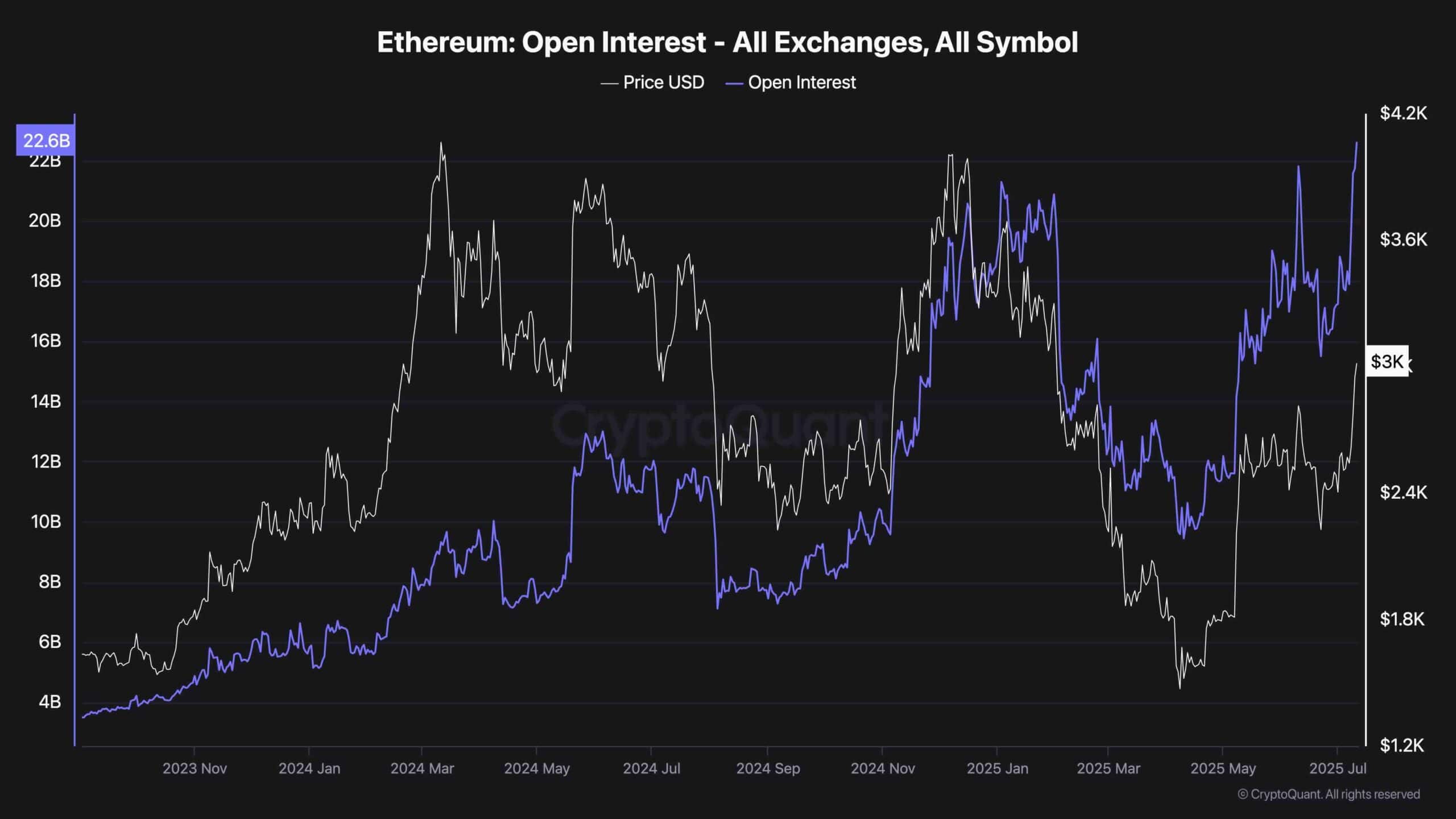

Ethereum’s open curiosity throughout all exchanges has reached a brand new excessive of $22.6B, whereas value pushes simply above the $3K mark. This sharp rise in open curiosity, with out an equally aggressive transfer in value, indicators a surge in leveraged positioning. Such habits usually precedes volatility, as crowded trades might set off liquidations on both aspect if тхе value swings sharply.

Whereas the rise in open curiosity might assist continuation if fueled by real spot demand, it additionally raises the chance of short-term corrections. If this open curiosity is overly long-heavy, a pullback may power a wave of liquidations and rapidly drive the worth again towards key assist ranges.

Total, the open curiosity surge displays rising market participation, but it surely additionally means that ETH could also be approaching a degree the place leverage turns into a double-edged sword.