After a pointy retreat from the $2,640 zone earlier this week, the Ethereum value immediately is consolidating close to $2,523. The broader chart construction reveals ETH is compressing inside a symmetrical triangle, with key help close to $2,480 and visual resistance at $2,560. A number of indicators recommend the asset is getting ready for its subsequent directional transfer — however can bulls preserve their management?

What’s Taking place With Ethereum’s Worth?

ETHUSD value dynamics (Supply: TradingView)

On the 4-hour chart, Ethereum has rebounded from the $2,450 zone, reclaiming the mid-Bollinger Band and stabilizing simply above the 100 EMA at $2,486. All 4 EMAs (20/50/100/200) are actually clustering tightly between $2,486 and $2,525, indicating a pivotal space for ETH. A decisive transfer from this degree is prone to decide whether or not Ethereum value motion turns bullish or retreats.

ETHUSD value dynamics (Supply: TradingView)

Structurally, ETH continues to respect a broad ascending triangle shaped since early June, with greater lows seen close to $2,240 and a horizontal ceiling close to $2,560. The present candle construction reveals lowered volatility and tightening value motion — a basic setup for breakout continuation or breakdown reversal.

Why Is The Ethereum Worth Going Down Right this moment?

ETHUSD value dynamics (Supply: TradingView)

The current dip in Ethereum value might be attributed to overhead rejection from the $2,640–$2,660 resistance band, the place promoting stress persistently halted upside makes an attempt. As seen within the RSI and MACD on the 30-minute chart, momentum weakened sharply after failing to shut above $2,630.

Why Ethereum value happening immediately additionally pertains to bearish divergence noticed earlier this week, the place the RSI shaped decrease highs whereas value motion tried greater highs. This was adopted by a downward crossover in MACD and a drop under the VWAP zone.

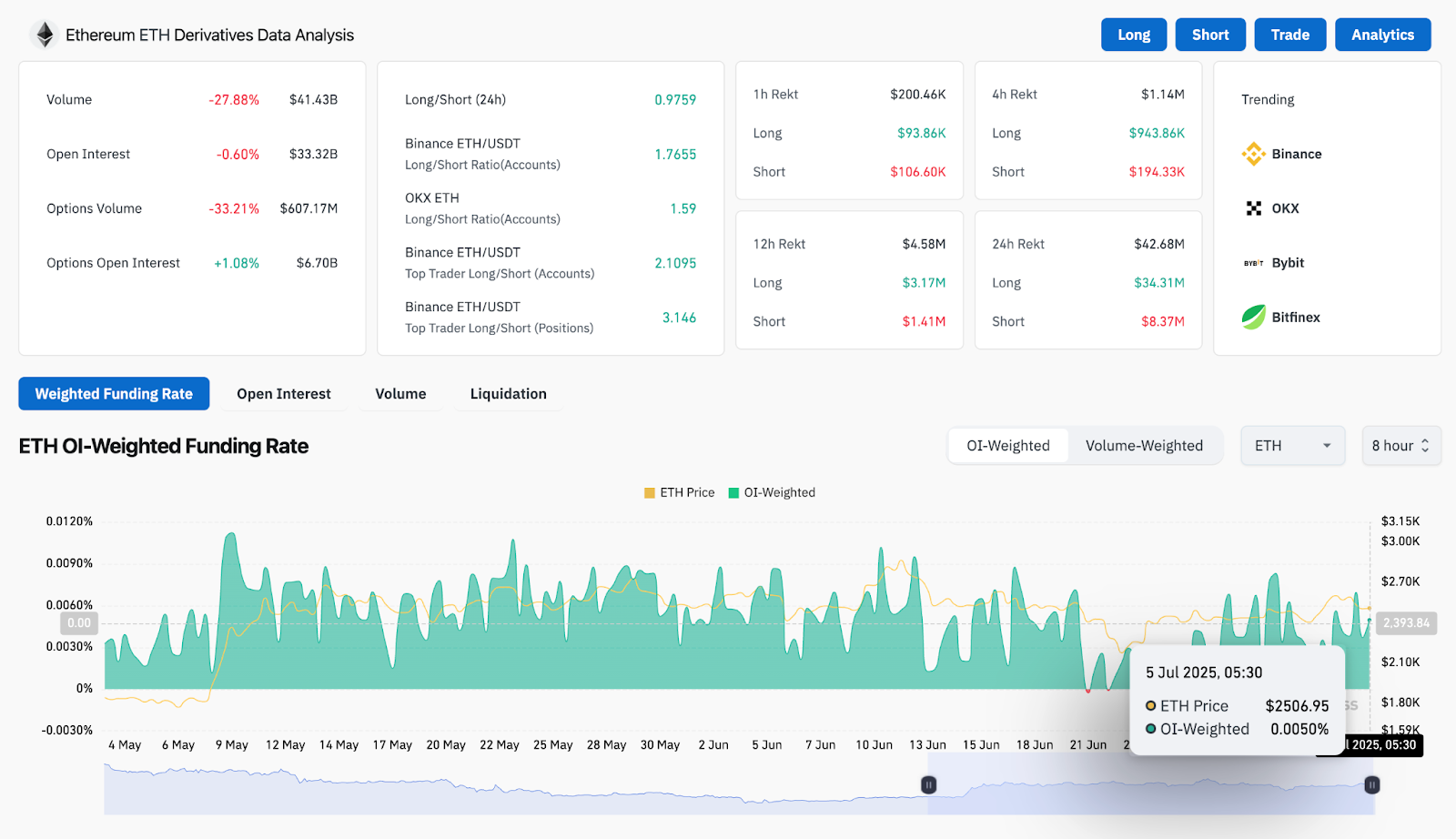

ETH Spinoff Evaluation (Supply: Coinglass)

Open curiosity information reveals a slight -0.6% contraction, and 24-hour liquidations have totaled $42.68 million, with extra short-side stress than long-side help. Whereas the lengthy/quick ratio on Binance stays barely bullish (2.10), a breakdown under $2,480 may invite one other spherical of stop-triggered promoting.

Key Indicators From Worth Indicators and Volatility Charts

ETHUSD value dynamics (Supply: TradingView)

On the 1-day chart, Ethereum remains to be inside a big symmetrical triangle, bounded by resistance close to $2,760 and help above $2,240. Fibonacci ranges drawn from the $4,100 excessive to the $1,385 backside present ETH reclaiming the 0.382 zone ($2,424), with the following main hurdle being the 0.5 retracement degree at $2,745.

Zooming out, the month-to-month chart reveals a long-term symmetrical triangle that has been growing since late 2021. ETH is now testing the higher boundary of this construction for the third time after bouncing from a multi-year ascending trendline. Notably, this triangle comprises two important decrease highs that align with rejection zones close to $3,465 and $4,096 — key macro resistance ranges. A decisive breakout above this triangle would sign a significant development reversal, doubtlessly establishing Ethereum for a retest of its all-time highs.

ETH Worth Prediction: Quick-Time period Outlook (24h)

ETHUSD value dynamics (Supply: TradingView)

The short-term outlook stays cautiously bullish so long as ETH holds above $2,480. Reclaiming $2,560 with quantity affirmation may open a retest of the $2,600–$2,640 liquidity pocket. A clear shut above that degree would recommend a breakout from the triangle and continuation towards $2,745.

On the draw back, a failure to carry $2,480 may end in a fast drop towards the $2,424 help (Fib 0.382), after which $2,360, the place prior breakouts have beforehand held.

Given the present low volatility, Ethereum value volatility is predicted to extend because the triangle apex nears. Merchants ought to watch the $2,480–$2,560 zone intently, as any breakout or breakdown from this vary may set off a multi-day development.

Ethereum Worth Forecast Desk: July 6, 2025

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.