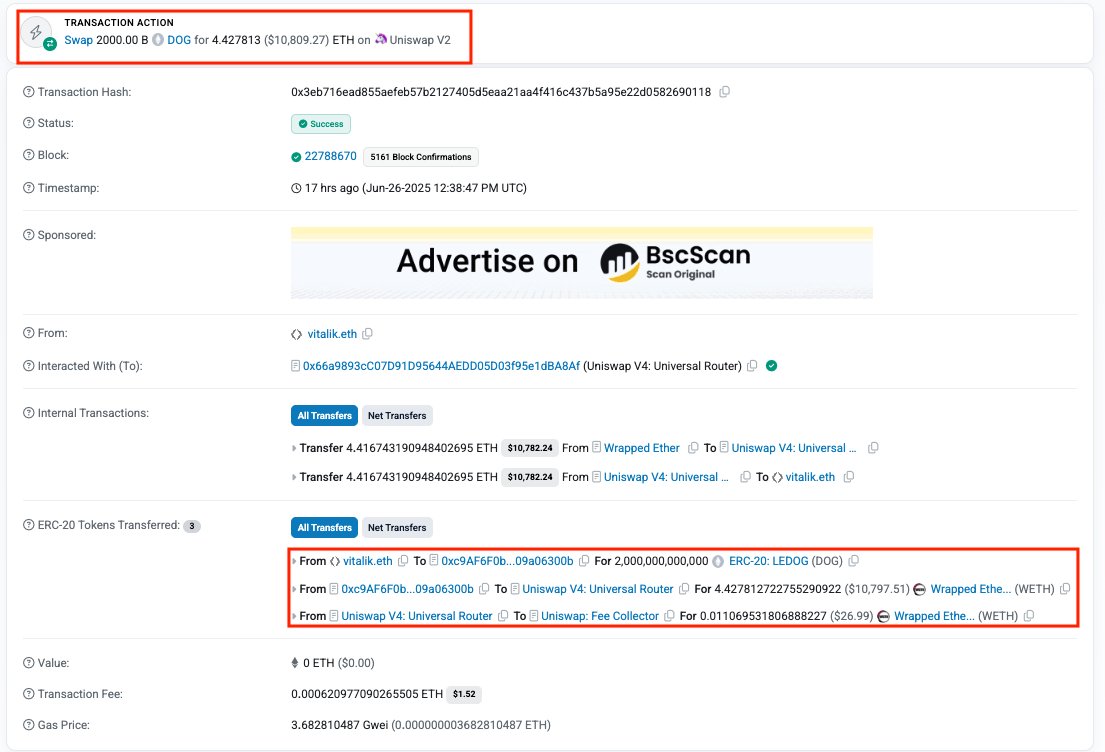

Vitalik Buterin, cofounder of Ethereum, not too long ago offered an astounding two trillion DOG tokens on Uniswap V4. The transaction, which is seen on the blockchain explorer, demonstrates that the tokens have been delivered to his deal with — probably with out his consent, as is often the case when meme coin builders try to capitalize on his notoriety. As a substitute of maintaining tokens, Vitalik shortly offered them, turning them into Ethereum, a choice that almost immediately prompted a stir available in the market.

The precise second this swap occurred is marked by a noticeable quantity spike on the ETH hourly chart. Quick-moving merchants and bots anticipated volatility from both a wider chain response or abrupt promote strain. In financial phrases, 4.4 ETH is hardly a whale-scale liquidation, however the symbolism is what counts, and holders have been identified to turn out to be alarmed by massive token gross sales by folks like Buterin.

Specifically, meme cash are prone to this. Previously, the tokens often go right into a loss of life spiral of panic promoting liquidity drains and plunging worth flooring when well-known people unload such holdings. Lots of low-cap initiatives skilled this collapsing practically instantly after their distributions have been dumping. If belief wanes, DOG could undergo the same destiny.

It is very important needless to say not all meme cash collapse immediately. For example, Shiba Inu managed to face up to a way more intensive sell-off by Buterin and subsequently turned one of many market’s largest meme belongings. Subsequently, though at this time’s motion is regarding, it isn’t essentially a loss of life sentence; nonetheless, the onus of proof rests with the DOG group to keep up the road.

Moreover given Buterin’s historical past of swiftly redistributing or promoting such belongings, the ETH that was bought would possibly wind up again in the marketplace. This potential overhang raises extra issues about Ethereum’s short-term worth stability. Micro-cap meme coin house owners ought to at all times consider their dangers appropriately with a view to keep away from losses ignited by massive sell-offs.