As geopolitical tensions between Iran and Israel escalate as soon as once more, international danger urge for food is taking a success. These conflicts usually inject short-term volatility throughout conventional and crypto markets, and Ethereum is not any exception.

Whereas ETH has held comparatively regular above $2,500 in current weeks, the rising concern in macro markets is starting to floor in worth construction and sentiment shifts.

It is a delicate second for merchants: ETH sits on the sting of a vital vary, and what occurs subsequent could hinge as a lot on exterior occasions as technical components.

Technical Evaluation

By ShayanMarkets

The Day by day Chart

Ethereum’s day by day chart exhibits a transparent rejection from the $2,800 resistance space, which additionally aligns with the 200-day transferring common and a bearish order block. After a robust aid rally from the $1,500 area earlier this quarter, ETH consolidated in an ascending channel sample however is now more likely to break under the decrease trendline of that channel.

This construction usually indicators exhaustion in bullish momentum, particularly when the market fails to push larger regardless of favorable short-term setups. The RSI has additionally dropped again underneath the 50 mark, reflecting bearish momentum.

The worth is now re-entering the mid-range zone, between $2,800 and $2,150. If Ethereum fails to reclaim $2,800 quickly, the door will open for a attainable transfer again towards the $2,150 assist degree, which coincides with the 100-day transferring common and the highest of the final main accumulation vary. A bounce from there could be vital to protect the broader bullish bias in current months.

The 4-Hour Chart

On the 4H chart, the asset has damaged down from the ascending channel it had been respecting for weeks. The rejection from the $2,800 order block created a pointy drop that left behind an imbalance (FVG) close to the $2,600 zone, presently appearing as short-term resistance. The construction now resembles a possible distribution section, notably if the worth breaks under the channel with out contemporary shopping for strain.

The RSI additionally stays weak, hovering just under 50, and exhibits no indicators of bullish divergence. There may be additionally a notable lack of quantity on current bounces, suggesting that demand is drying up as macro uncertainty looms. If the channel breakdown happens, ETH may retrace towards the $2,300 demand zone. Holding that space could be essential, as dropping it may invite a deeper correction towards $2,100, the place stronger bullish curiosity doubtless awaits.

Sentiment Evaluation

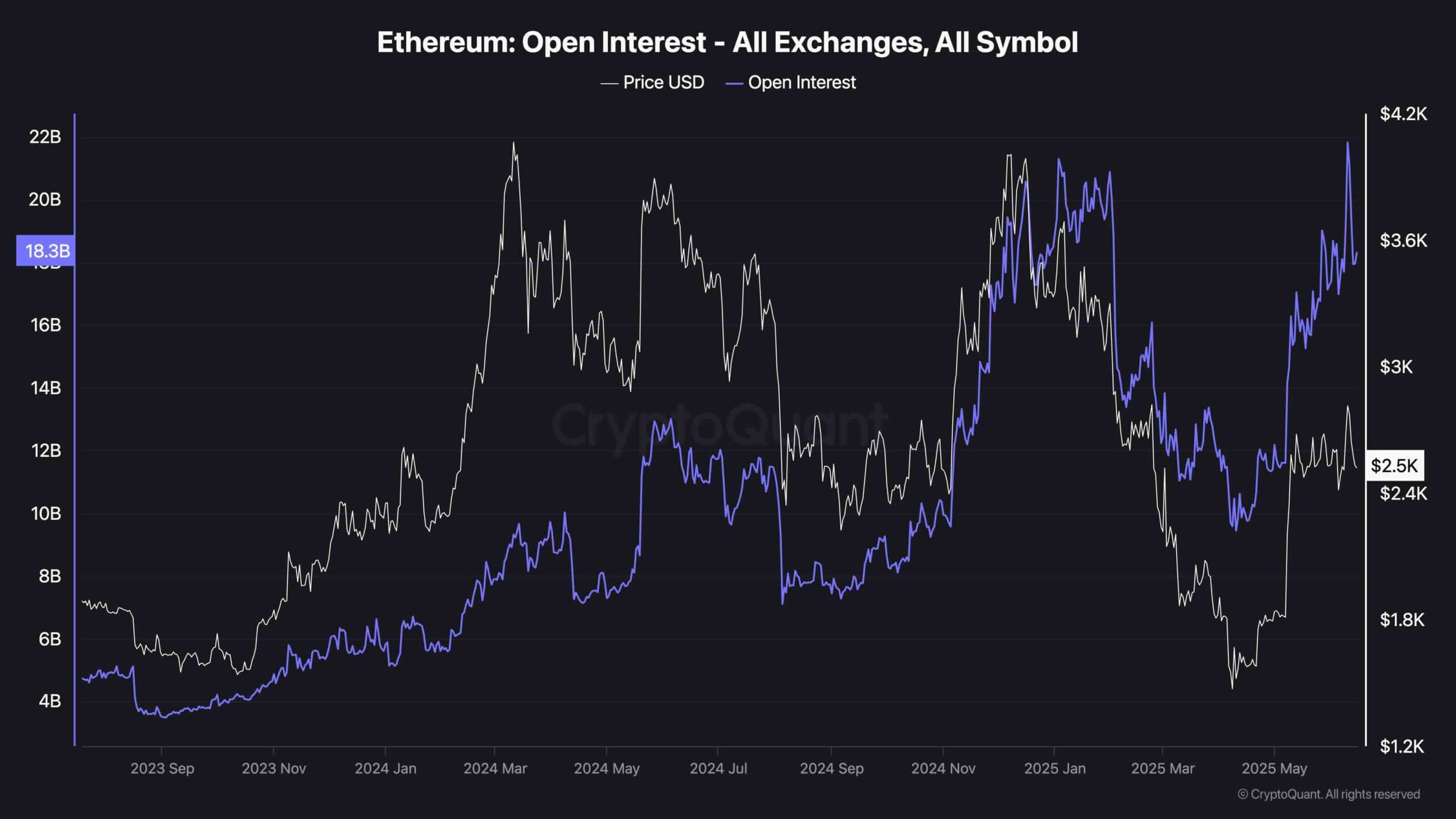

Open Curiosity (OI) on Ethereum derivatives has briefly reached its highest level over the previous couple of years, exceeding $21B, earlier than experiencing a marginal drop because of the liquidity brought on by the tensions within the Center East. What makes this improvement much more fascinating is that this surge in OI is happening whereas ETH is buying and selling considerably decrease than it did the final time OI was this elevated.

This divergence usually indicators a buildup of leveraged positions—each lengthy and brief—which are but to be flushed out of the system.

Traditionally, such OI-price divergence usually precedes large-scale liquidation occasions. If the market can’t generate a clear breakout quickly, a volatility spike triggered by the unwinding of over-leveraged positions may occur. This aligns with the rising geopolitical danger, which may catalyze a quick repricing if international buyers transfer to risk-off property. In different phrases, derivatives are flashing a warning. Even when the worth seems calm, the undercurrent is something however steady.