On-chain information suggests Ethereum doesn’t face any dominant resistance ranges till $3,417, one thing that might open up the trail to the mark.

Ethereum Value Foundation Distribution Exhibits Resistance Forward Is Extra Unfold Out

In a brand new put up on X, the on-chain analytics agency Glassnode has talked about how the Value Foundation Distribution is in search of Ethereum proper now. The “Value Foundation Distribution” is an indicator that tells us about how a lot of the asset’s provide was final bought at which worth ranges.

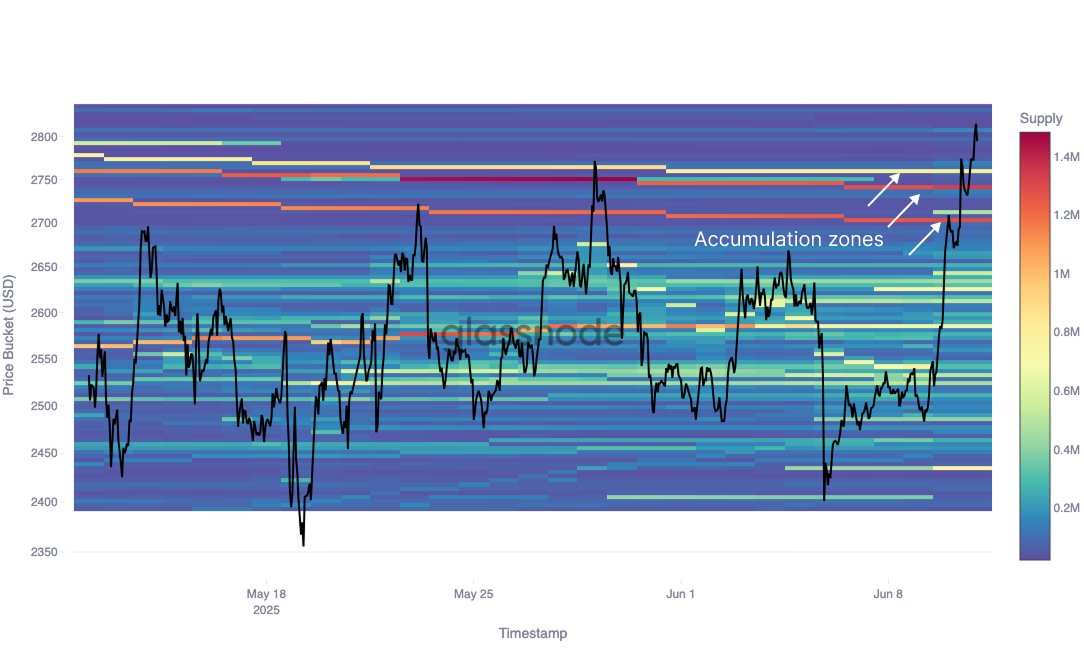

First, here’s a chart that reveals what the cryptocurrency’s newest breakout has been like from the angle of this indicator:

As displayed within the above graph, Ethereum has managed to interrupt via a number of notable provide ranges with the most recent worth surge. Each the $2,700 and $2,740 ranges maintain the associated fee foundation of about 1.3 million ETH, whereas the $2,760 mark holds that of 800,000 ETH. In on-chain evaluation, ranges concentrated with provide are thought of essential, as a result of easy proven fact that traders are more likely to present a response to cost interactions with their price foundation.

When this retest happens from beneath, the holders could react by promoting their cash. Loss traders could be determined to get again into the inexperienced, so when the value does return to their break-even, they will panic and exit out of worry that they’ll return underwater within the close to future.

Naturally, the extra traders that share their price foundation at a specific degree, the stronger this type of promoting response tends to be. As such, ranges above that maintain a big quantity of provide can act as resistance boundaries to ETH’s worth. Ethereum was earlier caught beneath the aforementioned provide zones for a month, probably due to this resistance impact, however now the cryptocurrency has lastly reclaimed them.

Similar to how sturdy ranges above can pose resistance, these beneath is usually a heart of assist as a substitute. As such, it’s doable that the function of the $2,700, $2,740, and $2,760 provide partitions would now change. “These traders amassed throughout consolidation and now will probably kind a robust assist zone,” notes Glassnode.

The assist impact can come up from holders carrying a bullish mindset and declines to their price foundation as dip-buying alternatives, or just from them wanting to guard their acquisition boundary.

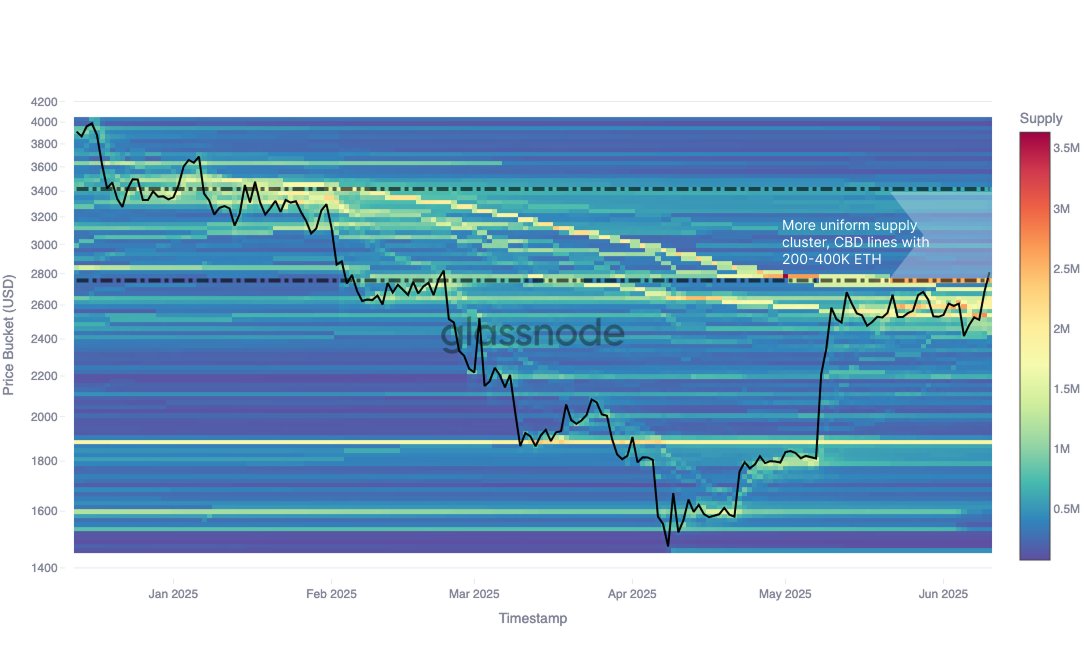

Now, right here is one other chart shared by the analytics agency that reveals how the Ethereum Value Foundation Distribution appears to be like for the degrees forward of the most recent spot worth:

From the graph, it’s seen that the degrees forward have the Ethereum provide distributed in a extra uniform method, with no sturdy clusters current till $3,417. Extra particularly, the value ranges earlier than this mark include 200,000 to 400,000 ETH at each $50 hole. Compared, the $3,417 degree at the moment holds the associated fee foundation of about 607,950 ETH.

“If the $2.70K–$2.76K assist vary holds, the trail to $3.42K stays technically open – however the response from holders within the $2.8K–$3.3K vary will outline how rapidly ETH can climb – at the moment, it’s already 47.5% up QTD,” explains Glassnode.

ETH Value

Ethereum briefly broke above $2,830 prior to now day, however the coin has since confronted a pullback because it’s again at $2,780.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com