Ethereum continues to face sturdy resistance close to the important 200-day shifting common at $2.7K, with latest worth conduct hinting at a possible bearish reversal.

The shortage of sustained shopping for momentum suggests {that a} extended consolidation part, probably extending down towards the $2.2K help zone, is more and more doubtless within the mid-term.

Technical Evaluation

The Each day Chart

ETH continues to wrestle beneath the important 200-day shifting common, presently positioned across the $2.7K mark. This stage has persistently acted as a ceiling over latest weeks, signaling a agency zone of promoting stress and hesitation amongst consumers. The failure to reclaim this key threshold has led to indicators of weak spot, as the value begins to kind a distribution vary, hinting at a possible corrective transfer.

Given the shortage of sturdy bullish momentum, a gradual decline towards the $2.2K help seems more and more doubtless within the coming classes. This zone might function a requirement pocket, providing the market a reset alternative earlier than making an attempt one other breakout above the $2.7K barrier. Nevertheless, ought to sellers achieve additional management, Ethereum may even retest the 100-day MA close to $2K as the subsequent line of protection.

The 4-Hour Chart

On the decrease timeframe, Ethereum is buying and selling inside a rising wedge formation, sometimes a bearish reversal sample, indicating fading purchaser power and heightened threat of a downward breakdown. This construction aligns with seen bearish divergence on the RSI indicator, reinforcing the view that distribution is underway close to the present resistance.

A breakdown beneath the wedge’s decrease boundary, presently round $2.4K, would doubtless open the door to a drop towards the $2.2K zone. Conversely, if Ethereum unexpectedly breaks above the higher boundary, a fast brief squeeze may unfold, doubtlessly propelling the value towards greater resistance ranges in a pointy restoration transfer.

On-Chain Evaluation

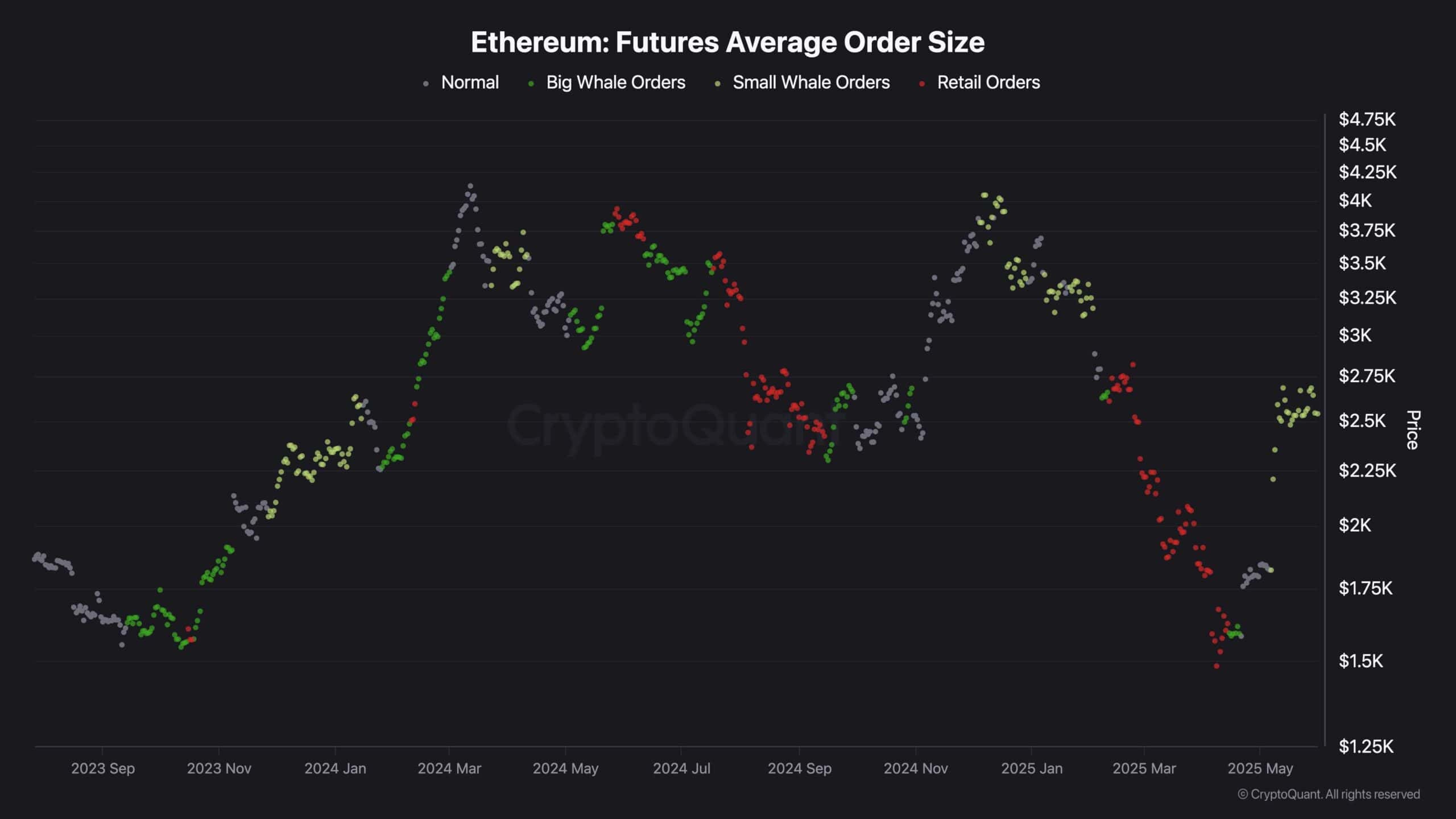

Ethereum’s worth continues to fluctuate simply beneath a key resistance zone, leaving merchants unsure in regards to the asset’s subsequent vital directional transfer. One useful metric on this context is the Common Order Dimension of Executed Trades, which reveals the dimensions of exercise from completely different market contributors.

A surge on this metric typically factors to elevated participation from whale traders. Traditionally, bigger order sizes have coincided with main native tops, as whales have a tendency to interact in strategic profit-taking or distribution at elevated worth ranges.

At current, this metric has climbed noticeably, signaling heightened whale exercise inside the important $2.5K to $2.8K resistance band. This sample suggests that giant traders could also be offloading positions or hedging, anticipating a possible shift in momentum.

Because of this, barring a shock bullish breakout, the percentages presently favour continued consolidation or perhaps a deeper pullback within the mid-term, probably towards decrease help ranges. Buyers ought to stay cautious and look ahead to additional cues from each worth construction and institutional behaviour.