On Might 24, 2025, bitcoin ( BTC) is coasting alongside at $109,273, reflecting a considerable valuation amid an energetic buying and selling session. With a market capitalization of $2.17 trillion and a 24-hour buying and selling quantity of $46.66 billion, the worth oscillated between an intraday low of $107,156 and a peak of $109,840.

Bitcoin

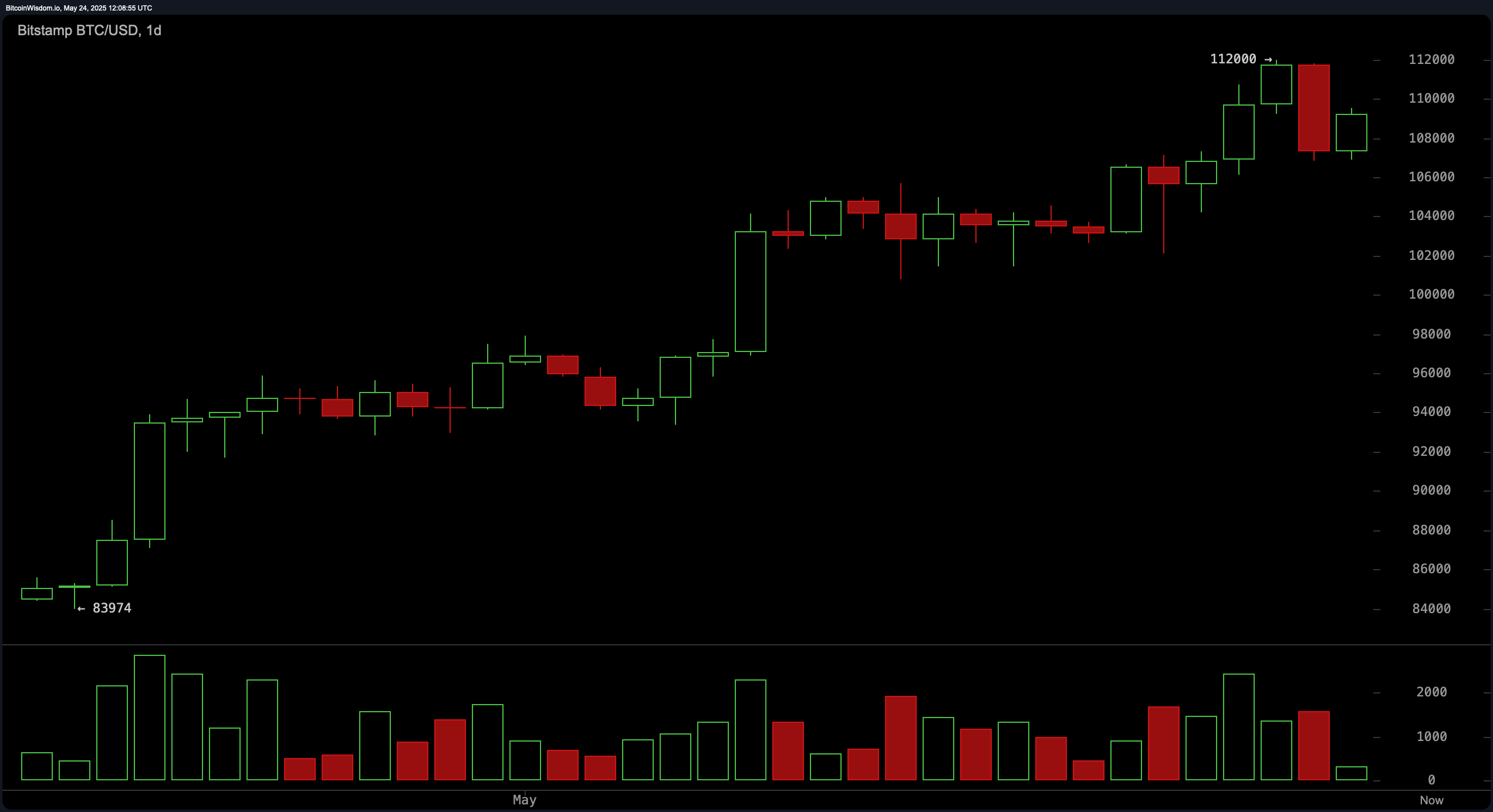

On the day by day chart, bitcoin (BTC) is in a bullish pattern, regardless of a current retracement from a neighborhood excessive of $112,000. The help zone close to $98,000–$100,000 stays essential, backed by historic demand earlier within the month. Resistance is clearly outlined at $112,000, a stage the place important promoting strain emerged. Whereas inexperienced candles earlier within the rally have been supported by quantity, the purple candle on the prime signifies warning. If bitcoin holds above the $106,000–$107,000 vary and prints a bullish engulfing candle, merchants might view this as a strategic entry level, whereas exhaustion alerts close to $112,000 would warrant exits.

BTC/USD 1-day chart through Bitstamp on Might 24, 2025.

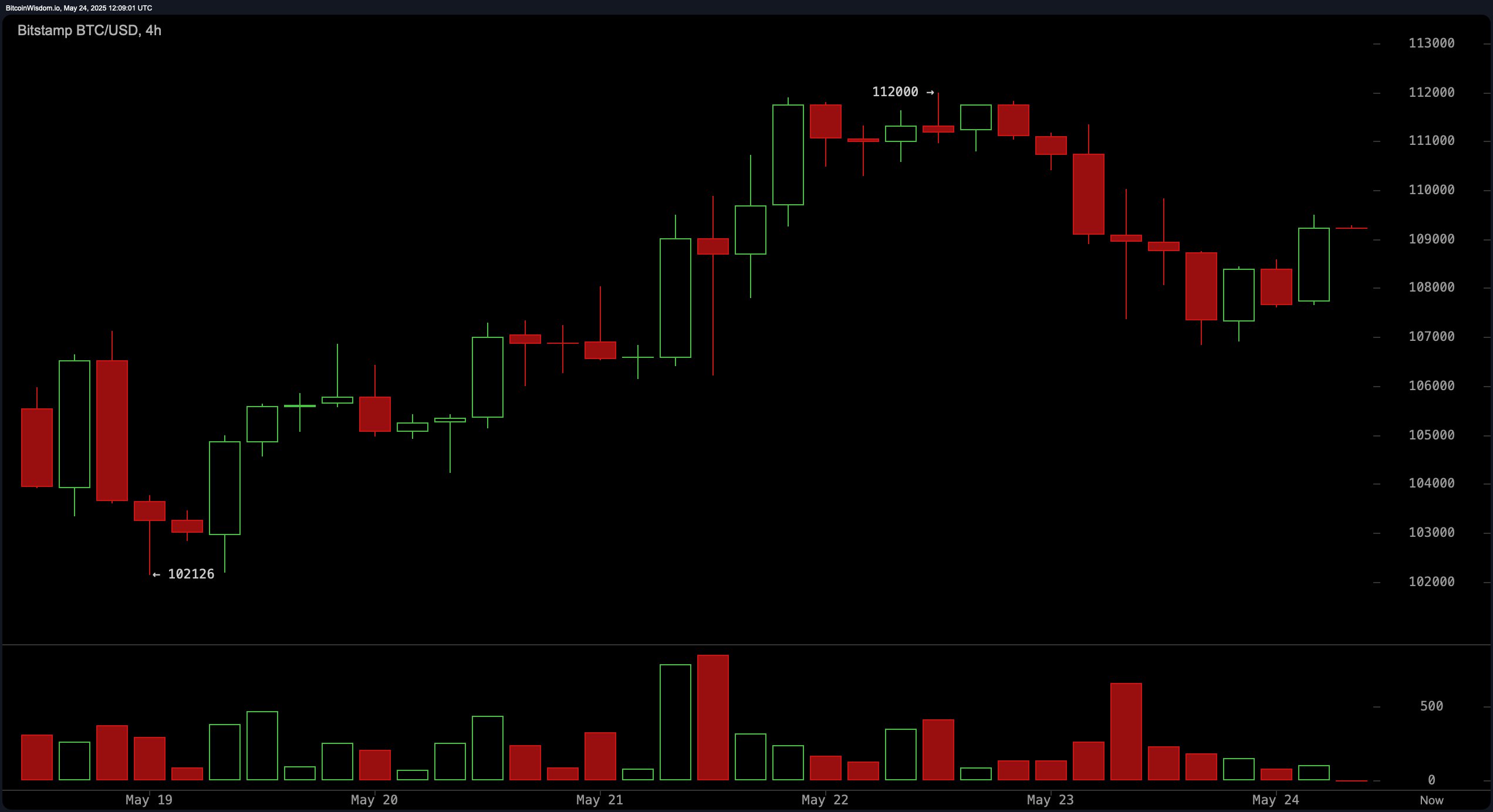

The 4-hour chart presents a neighborhood correction narrative, tracing a descending channel after peaking at $112,000. A restoration to over $109,000 alerts potential reversal, albeit with subdued quantity following a previous panic-driven decline. The technical sample hints at an upside break ought to bitcoin shut above $110,000 with affirmation by quantity. Conversely, a drop under the $108,000 threshold with bolstered bearish quantity may point out a return to the $106,000 stage, reintroducing warning into the market.

BTC/USD 4-hour chart through Bitstamp on Might 24, 2025.

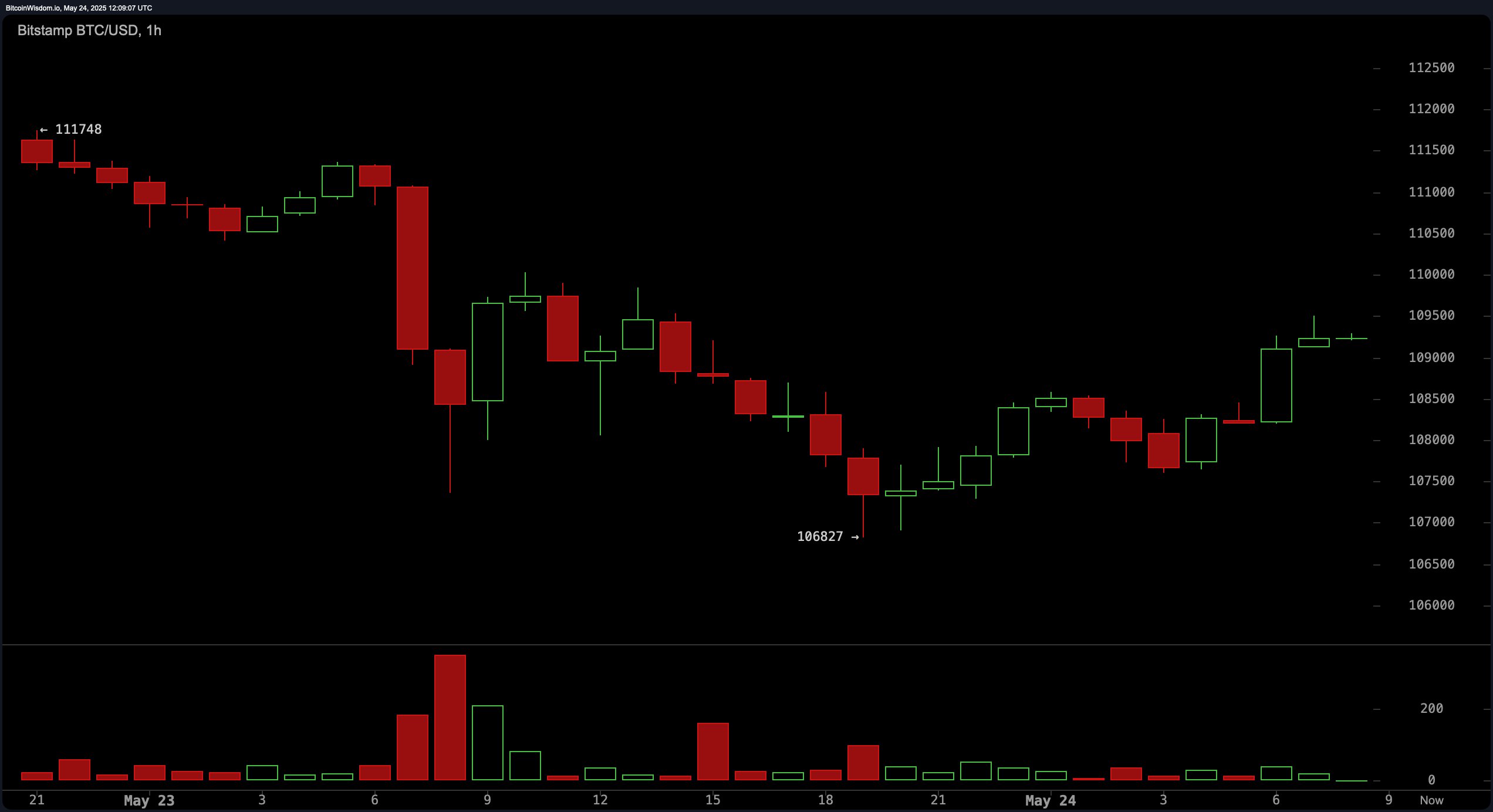

Brief-term value motion on the 1-hour chart shows a speedy decline from $111,748 to $106,827, adopted by a gradual rebound. An rising inverse head and shoulders sample, characterised by the formation of the proper shoulder, helps a bullish near-term outlook. Breakout affirmation lies between $109,500 and $110,000. Ought to bitcoin fall and shut under $108,000 with notable sell-side exercise, this could invalidate the reversal premise and recommend renewed bearish momentum.

BTC/USD 1-hour chart through Bitstamp on Might 24, 2025.

Oscillator readings are blended, suggesting a market in equilibrium. The relative power index (RSI) at 66, Stochastic at 77, and common directional index (ADX) at 33 all sign neutrality. Nonetheless, the momentum oscillator at 5,747 and the transferring common convergence divergence (MACD) at 4,016 point out bullish bias, whereas the commodity channel index (CCI) at 113 flashes a promote sign, implying overbought situations. The Superior oscillator corroborates the broader impartial sentiment.

Transferring averages paint a strongly bullish backdrop. All short- to long-term exponential transferring averages (EMAs) and easy transferring averages (SMAs)—starting from the 10-period EMA at $107,056 to the 200-period EMA at $89,495—are signaling optimistic situations. This alignment means that regardless of short-term corrections, the general pattern stays upward. The confluence of bullish alerts throughout a number of timeframes affirms investor confidence and positions bitcoin for additional good points if key resistance ranges are damaged with robust affirmation.

Bull Verdict:

Bitcoin’s value motion stays underpinned by robust technical help and constant purchase alerts throughout all main transferring averages. If it breaks above $110,000 with quantity affirmation, the stage is ready for a renewed push towards and probably past the $112,000 resistance. The broader pattern is bullish, and momentum indicators recommend upside continuation.

Bear Verdict:

Regardless of a prevailing bullish construction, warning is warranted. A failure to take care of help above $108,000, particularly with rising promote quantity, may set off a deeper pullback towards $106,000 or decrease. Combined oscillator alerts and overhead resistance at $112,000 reinforce the chance of short-term exhaustion and reversal.