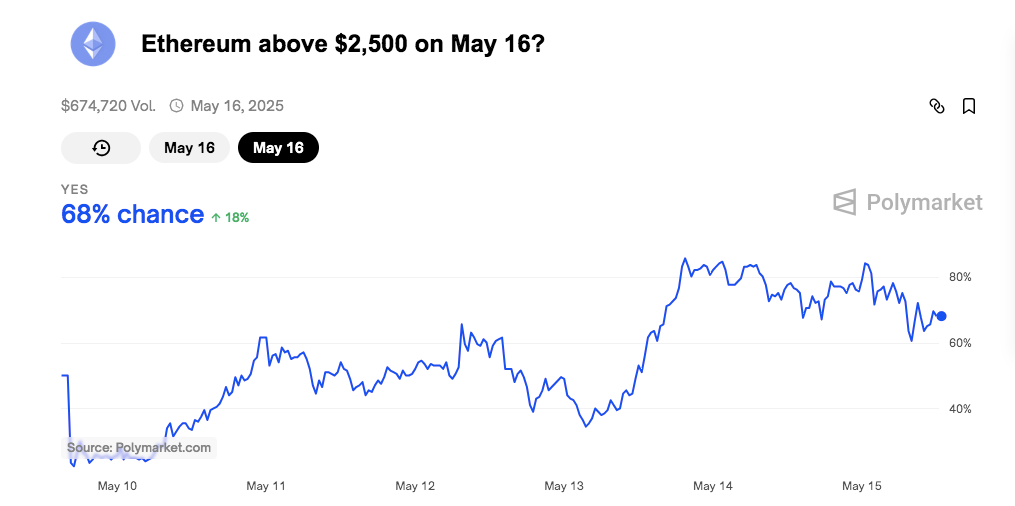

Ethereum’s market sentiment has shifted notably because the prediction market on Polymarket now exhibits a 72% likelihood that the cryptocurrency will stay above $2,500 on Might 16, 2025.

This bounce represents a 22% surge in dealer confidence, sparked by rising optimism and elevated buying and selling exercise over latest days. The change in sentiment displays a broader pattern the place merchants are recalibrating their outlook based mostly on each technical indicators and market psychology.

Polymarket Prediction Sees Excessive Quantity, Investor Conviction

Supply: Polymarketcap

Moreover the rise in chance, the market has drawn vital consideration. Buying and selling quantity for this specific prediction reached $674,720, exhibiting sturdy participation and conviction amongst speculators.

Apparently, this surge in confidence got here regardless of Ethereum’s short-term dip, suggesting that traders could also be specializing in longer-term fundamentals fairly than every day fluctuations.

Associated: ETH Outlook Brightens: Hedge Funds Shift to Favor Ethereum

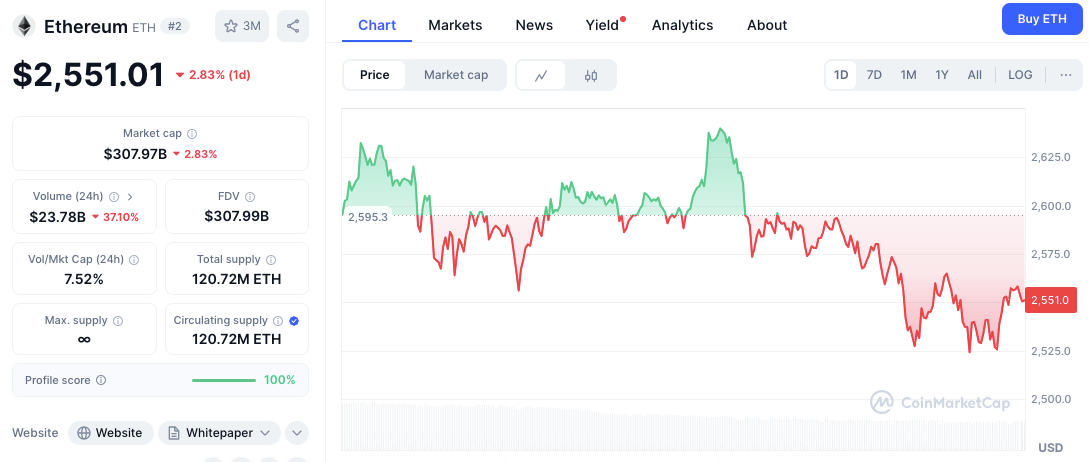

ETH Value Motion and Key Technical Ranges to Watch

On the time of writing, Ethereum is buying and selling at $2,554.71, marking a 2.86% every day decline. This drop follows a pointy reversal from latest highs close to $2,650. The chart sample exhibits a sequence of decrease highs and decrease lows, which typically factors to a bearish short-term pattern. Nevertheless, the larger image might inform a unique story.

Assist and resistance ranges have gotten extra outlined. Rapid resistance stands at $2,595, a stage that has rejected value advances a number of occasions lately. Additional resistance lies at $2,625, which was the native excessive earlier than the present pullback. If bulls handle to push the worth above this zone, it might mark the start of a short-term rally.

Supply: CoinMarketCap

On the draw back, key help is at $2,525, the place the worth bounced earlier. A extra important stage lies at $2,500. This zone carries each psychological weight and technical significance. A breakdown beneath this might open the door to additional losses, doubtlessly eroding the latest bullish sentiment.

Momentum Indicators: ETH Overbought on RSI, MACD Nonetheless Bullish

ETH/USD every day value chart, Supply: TradingView

From an indicators perspective, the RSI is presently at 72.25, which locations Ethereum in overbought territory. This implies {that a} short-term pullback or value consolidation is feasible. Overbought circumstances typically precede market corrections, although they don’t at all times sign long-term weak point.

Associated: ETH Value Stays Robust Above $2.5K Regardless of Wild Change Flows & Large $1.2B Withdrawal

In the meantime, the MACD stays in bullish alignment, with the MACD line above the sign line. This crossover factors to ongoing upward momentum, however declining value motion might quickly weaken this sign. A narrowing hole between these strains might sign a momentum shift if value help fails to carry.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.