Donald Trump’s commerce conflict tariffs have triggered vital volatility in crypto markets this week, resulting in a decline in Ethereum’s worth. At press time, the main altcoin is buying and selling at $2,347, a low final recorded in November.

With costs dropping, ETH buyers have turn into more and more bearish, eradicating their capital from the funding funds backed by the altcoin.

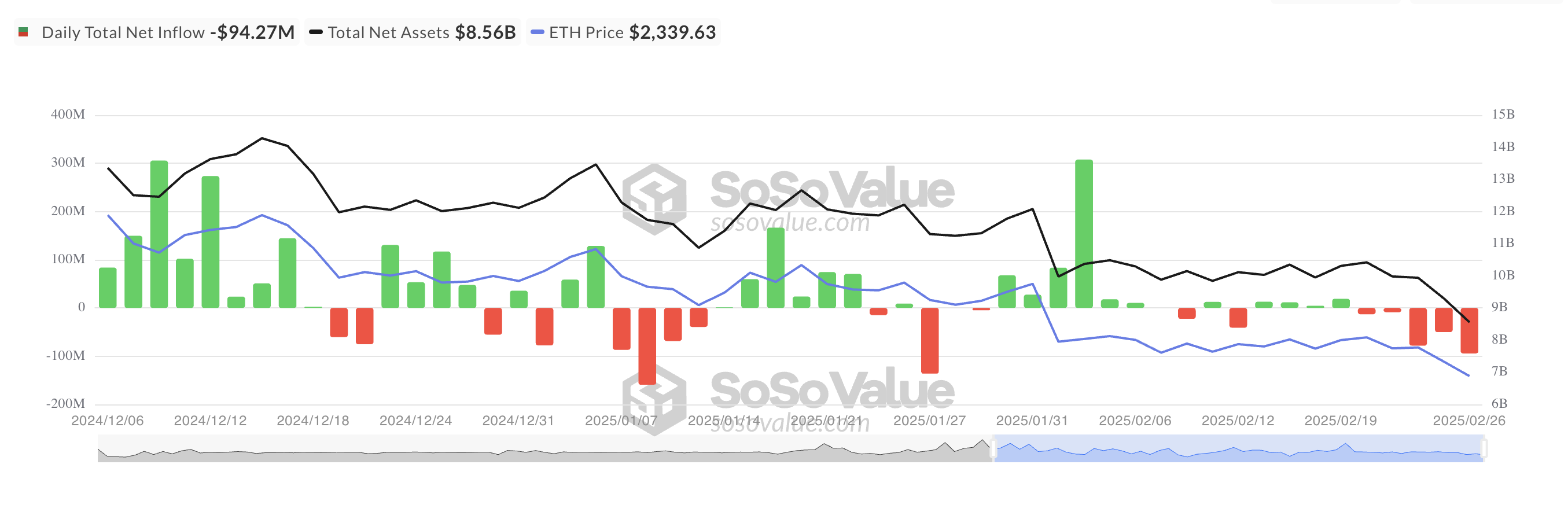

ETH Spot ETF Outflows Surge to 30-Day Excessive

In line with knowledge from SosoValue, web outflows from ETH spot ETFs climbed to a 30-day excessive of $94.27 million on February 26. This marked the third-highest single-day web outflows because the starting of the yr, and it adopted the coin’s value decline to an intraday low of $2,251.

Whole Ethereum Spot ETF Internet Influx. Supply: SoSoValue

On Wednesday, Blackrock ETF ETHA had a single-day web outflow of $69.76 million, bringing the full web quantity in US {dollars} that has flowed into the fund because it was first listed to $4.33 billion. Constancy’s FETH noticed the second-largest web outflow on that day, totaling $18.38 million, bringing its cumulative web influx to $1.51 billion.

When ETH ETFs see web outflows like this, buyers are withdrawing extra funds than they put in, signaling decreased confidence or profit-taking. For context, ETH spot ETF buyers have steadily eliminated their capital from these funds since February 21. Persistent outflows like this point out bearish sentiment and put extra downward strain on ETH’s value.

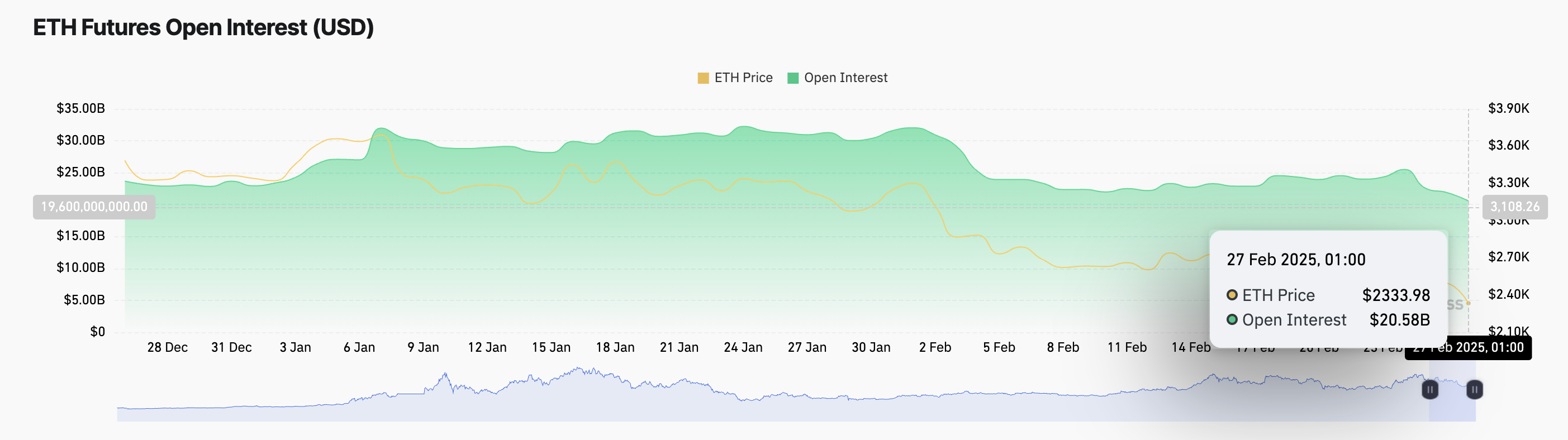

Notably, ETH’s falling open curiosity in its futures market highlights the market-wide bearish bias towards it. At press time, this sits at $20.58 billion, declining by 20% because the starting of this week. Throughout the identical interval, ETH’s value has plummeted by 17%.

Ethereum Open Curiosity. Supply: Coinglass

An asset’s open curiosity measures the full variety of excellent by-product contracts, like futures or choices, that haven’t been settled. When it falls alongside the asset’s value, merchants are closing positions relatively than opening new ones.

This indicators weakening market curiosity in ETH and hints on the chance of a sustained decline in its worth.

ETH Breaks Key Assist, Eyes Yearly Low of $2,150

On the day by day chart, ETH at present trades under the decrease line of the horizontal channel it has trended inside for many of February. This means a powerful help degree breach and hints at potential additional draw back. On this situation, ETH’s value might revisit its year-to-date low of $2,150.

Ethereum Value Evaluation. Supply: TradingView

Conversely, if market sentiment improves and new demand trickles into the ETH market, it might drive its worth to $2,467. A break above this resistance might ship ETH’s value as much as $2,585.