Cautious market sentiment and a broader pullback in crypto exercise seem like stalling bitcoin’s value over the previous 24 hours.

Buying and selling Quantity Droop Retains Bitcoin Beneath $97K Threshold

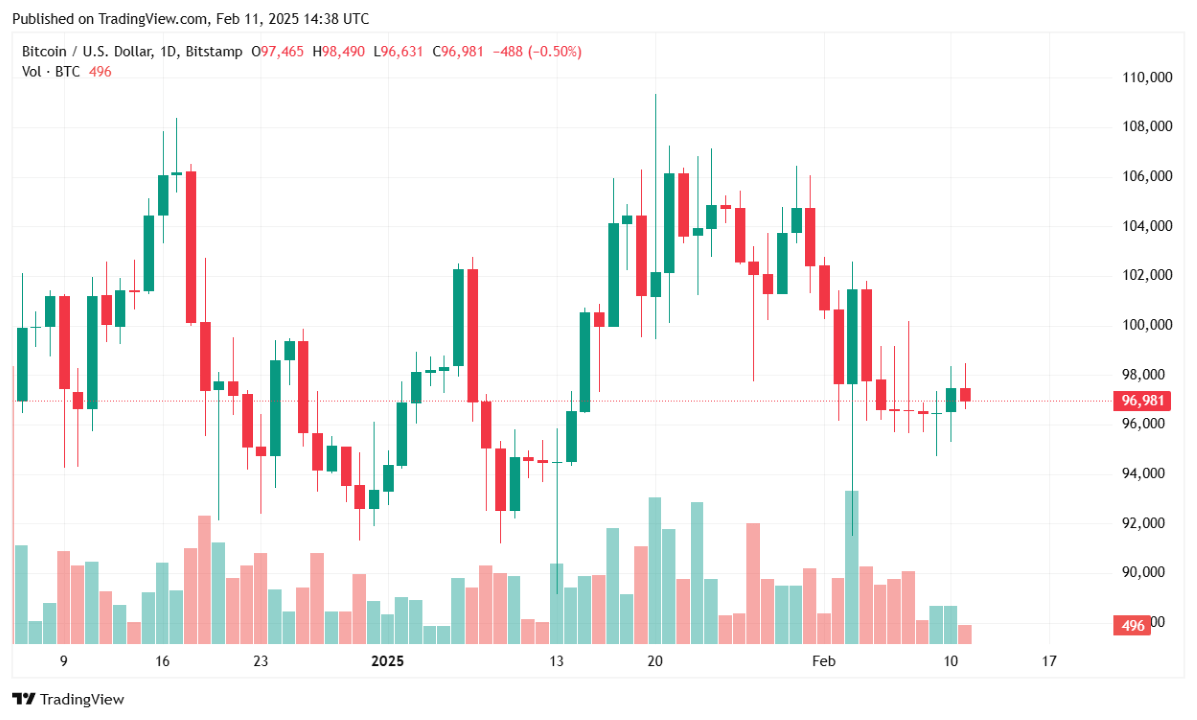

Bitcoin (BTC) is presently buying and selling at $96,985.60, displaying a slight 0.48% decline over the previous 24 hours and a 3.37% drop over the previous week. The asset has been buying and selling inside a 24-hour vary of $96,673.21 to $98,492.90, struggling to realize momentum as market sentiment stays cautious.

(BTC value / Buying and selling View)

Weaker Buying and selling Quantity and Market Cap Decline

Bitcoin’s 24-hour buying and selling quantity fell 17.68% to $31.63 billion, indicating lowered market exercise. This decline means that merchants are holding again from taking vital positions as BTC struggles to interrupt above resistance. In the meantime, bitcoin’s market capitalization slipped 0.83% to $1.92 trillion, reflecting the broader pullback within the crypto market.

Bitcoin Dominance and Futures Market

Regardless of latest volatility, BTC dominance rebounded 3.6% over the previous 24 hours after dipping barely earlier within the day, signaling a continued choice for the dominant cryptocurrency as extra traders consolidate into bitcoin. Nonetheless, bitcoin futures open curiosity fell 0.41% to $59.80 billion, suggesting that merchants are decreasing their leveraged publicity amid uncertainty.

Liquidations Replicate a Cautious Market

Whole bitcoin liquidations over the previous 24 hours amounted to $19.68 million, with $10.50 million in lengthy liquidations and $9.18 million in shorts. This comparatively balanced liquidation information suggests a scarcity of robust directional conviction, as each bulls and bears stay hesitant.

Market Outlook

Bitcoin continues to battle for upside momentum, with declining buying and selling quantity and futures open curiosity pointing to a cautious market. The $97,500 degree stays a key resistance zone, and a breakout above $98,500 might sign renewed bullish energy. Nonetheless, if BTC fails to carry above $96,500, additional draw back towards the $95,000 help degree might be on the horizon. Merchants will likely be watching macroeconomic traits and liquidity flows intently as bitcoin navigates this consolidation part.