Ethereum value has underperformed Bitcoin and different in style cash like Ripple and Solana this 12 months.

Ethereum (ETH) was buying and selling at $3,400, down by practically 20% from its highest stage in December final 12 months. This decline coincided with controversies surrounding the Ethereum Basis and its token gross sales.

ETH has additionally dropped as balances on exchanges have continued to rise, whereas the favored buy-sell ratio on Binance has remained bearish. Nonetheless, Ethereum has a number of catalysts that will push it to $5,000.

Ethereum Pectra improve

The primary main catalyst for Ethereum’s value is the upcoming Pectra improve, which is anticipated to happen in March. This will probably be one of many largest upgrades in Ethereum’s historical past, introducing a number of essential options.

The primary function will carry options like transaction bundling and gasoline sponsorship. It would additionally introduce the utmost efficient steadiness, which means that staking rewards will probably be added to a validator regardless of their dimension.

Moreover, the Pectra improve will enhance blob throughput, alter calldata prices, and allow execution layer triggerable exits. Traditionally, cryptocurrencies usually see value will increase forward of main updates.

4/ EIP-7691: Blob throughput enhance

Blobs have been at capability for a lot of months now which has restricted scalability for rollups/layer 2’s and elevated tx charges for customers.

With EIP-7691, the blob rely will probably be elevated from 3/6 to six/9, giving elevated scalability to rollups…

— sassal.eth/acc 🦇🔊 (@sassal0x) January 24, 2025

You may additionally like: Ethereum’s Pectra Devnet5 goes stay, Mainnet launch anticipated in March 2025

ETH’s open curiosity is rising

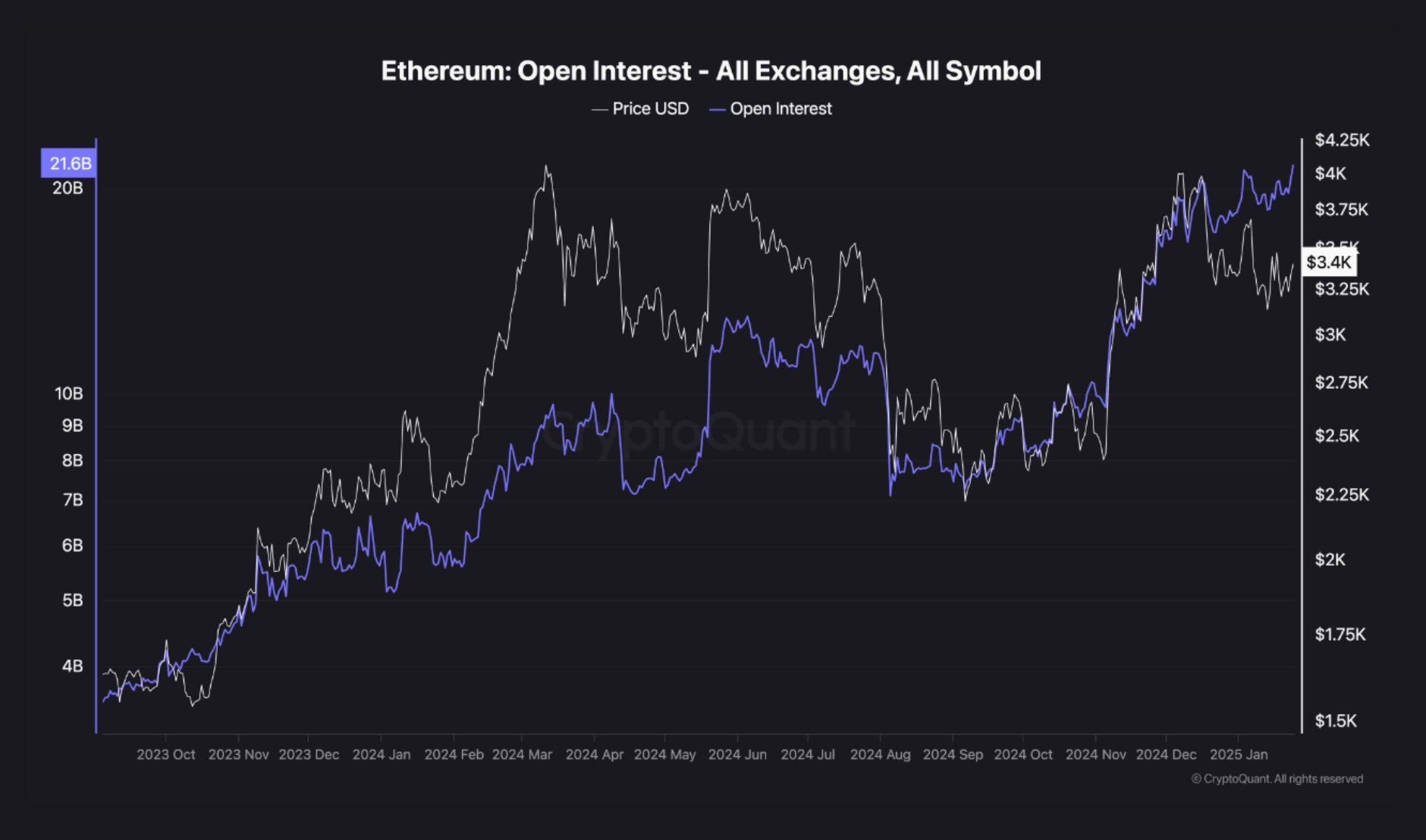

In the meantime, Ethereum’s open curiosity within the futures market has been rising, suggesting a possible value surge within the coming weeks. The chart under reveals a divergence between Ethereum’s value and its open curiosity. Whereas Ether has dropped practically 20% from its highest stage in November, open curiosity has continued to climb.

ETH open curiosity | Supply: CryptoQuant

Ethereum value has sturdy technicals

ETH value chart | Supply: crypto.information

The each day chart reveals that Ethereum’s value has sturdy technical indicators, which may push it considerably greater in the long term. ETH has shaped a falling wedge chart sample, composed of two descending and converging strains, which is extensively thought of a bullish sign.

Ethereum has additionally shaped an inverse head-and-shoulders sample, with its neckline at $4,082. The left and proper shoulders are across the $3,000 stage. This sample continuously precedes substantial value good points.

Moreover, the latest retreat aligns with the fourth part of the Elliott Wave sample. This part is usually adopted by a bullish fifth wave.

Consequently, Ethereum is prone to expertise a bullish breakout, with the preliminary key stage to observe at $4,082. A break above this stage may result in additional good points, doubtlessly testing the important thing resistance at $4,800, its all-time excessive. Past this, ETH may surge towards $5,000.

You may additionally like: Ethereum value is trapped, however leverage ratio factors to a rebound