Ethereum (ETH) has captured the highlight as soon as once more, at present buying and selling at $3,346.08 after a 4% surge prior to now 24 hours.

For practically 10 months, the cryptocurrency has remained inside a consolidation vary, reflecting market indecision. Nevertheless, its capacity to carry regular amid fluctuations has reignited curiosity amongst buyers keen to find out its subsequent transfer.

Because the world’s second-largest cryptocurrency reveals renewed momentum, AI fashions set formidable worth targets for 2025, projecting vital development fueled by a mixture of market dynamics and Ethereum’s multifaceted ecosystem.

ChatGPT units Ethereum worth for 2025

To evaluate Ethereum’s future potential, Finbold analyzed market information and sought insights from OpenAI’s superior ChatGPT-4o mannequin. The AI supplied a bullish outlook, projecting that Ethereum may attain $6,000 by mid-2025 and doubtlessly climb to $10,000 by the tip of the yr, assuming bullish momentum persists primarily based on present market dynamics.

Key components driving Ethereum’s worth

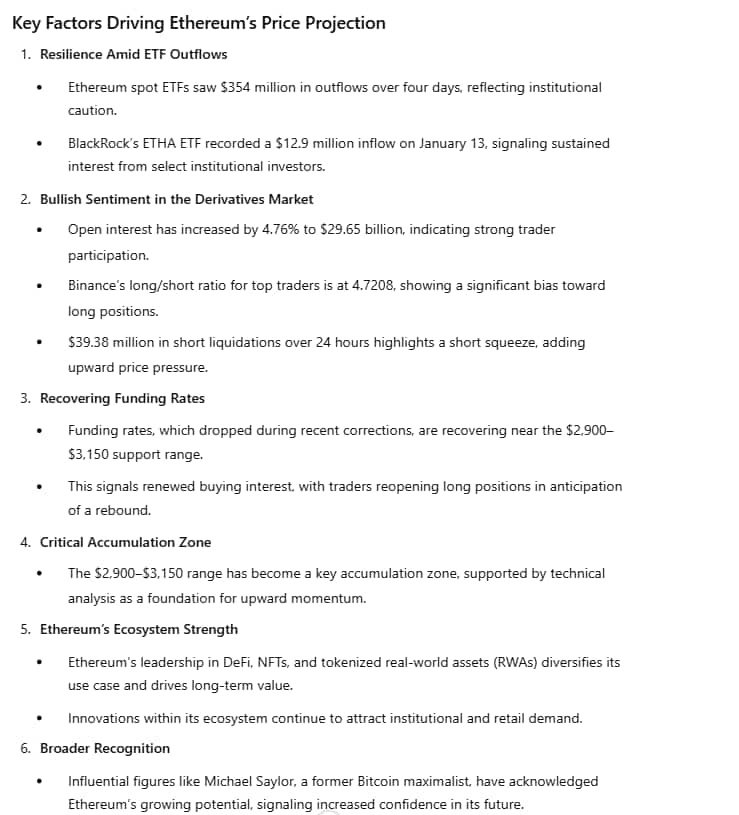

On January 13, Ethereum spot ETFs recorded $39.43 million in internet outflows, persevering with a four-day streak totaling $354 million. ChatGPT sees these sustained outflows as indicative of short-term warning amongst institutional buyers, seemingly influenced by the latest crypto market correction.

Nevertheless, not all institutional sentiment is bearish. BlackRock’s ETHA ETF noticed a internet influx of $12.9 million on the identical day, suggesting that curiosity in Ethereum stays robust in some quarters, at the same time as broader ETF outflows persist.

Ethereum’s capacity to climb above $3,150 regardless of these outflows highlights strong assist from merchants in different segments of the market.

Sturdy bullish sentiment within the derivatives market

ChatGPT notes that the derivatives market is sending robust bullish indicators. Open curiosity has risen 4.76% to $29.65 billion, reflecting rising dealer participation and confidence. On Binance, the lengthy/quick ratio for prime merchants is at 4.7208, exhibiting a transparent bias towards lengthy positions.

Moreover, $39.38 million in brief liquidations over the previous 24 hours suggests a brief squeeze, the place bearish merchants have been pressured out of their positions, including upward strain to Ethereum’s worth. ChatGPT sees these components as proof of accelerating optimism amongst market members, counterbalancing the bearish sentiment implied by ETF outflows.

Recovering funding charges sign renewed optimism

Funding charges, which fell sharply in the course of the latest market correction, are actually recovering as Ethereum holds its essential assist vary of $2,900 to $3,150. ChatGPT sees this restoration as an indication of renewed shopping for curiosity, with merchants reopening lengthy positions in anticipation of a rebound.

This accumulation zone has turn into a focus for each short-term merchants and long-term buyers, providing a key alternative to place for future features.

Technical evaluation helps this view, with the $2,900 to $3,150 vary performing as a basis for Ethereum’s upward momentum.

Moreover, projections from different AI fashions, reminiscent of Grok 2, additionally acknowledge Ethereum’s multifaceted ecosystem, together with its dominance in DeFi, NFTs, and the tokenization of real-world belongings (RWAs), as a key driver of long-term worth.

These insights reinforce Ethereum’s potential for development, notably because the restoration in funding charges, robust market participation, and its multifaceted ecosystem proceed to drive momentum.

Featured picture through Shutterstock