In a promising improvement, the Bitcoin worth is inching nearer to the coveted $100,000 mark because it trades above $98,000 for the primary time since late December.

Crypto analyst Ali Martinez has highlighted a number of crucial metrics that might sign additional bullish momentum for the main cryptocurrency because the market begins to get well.

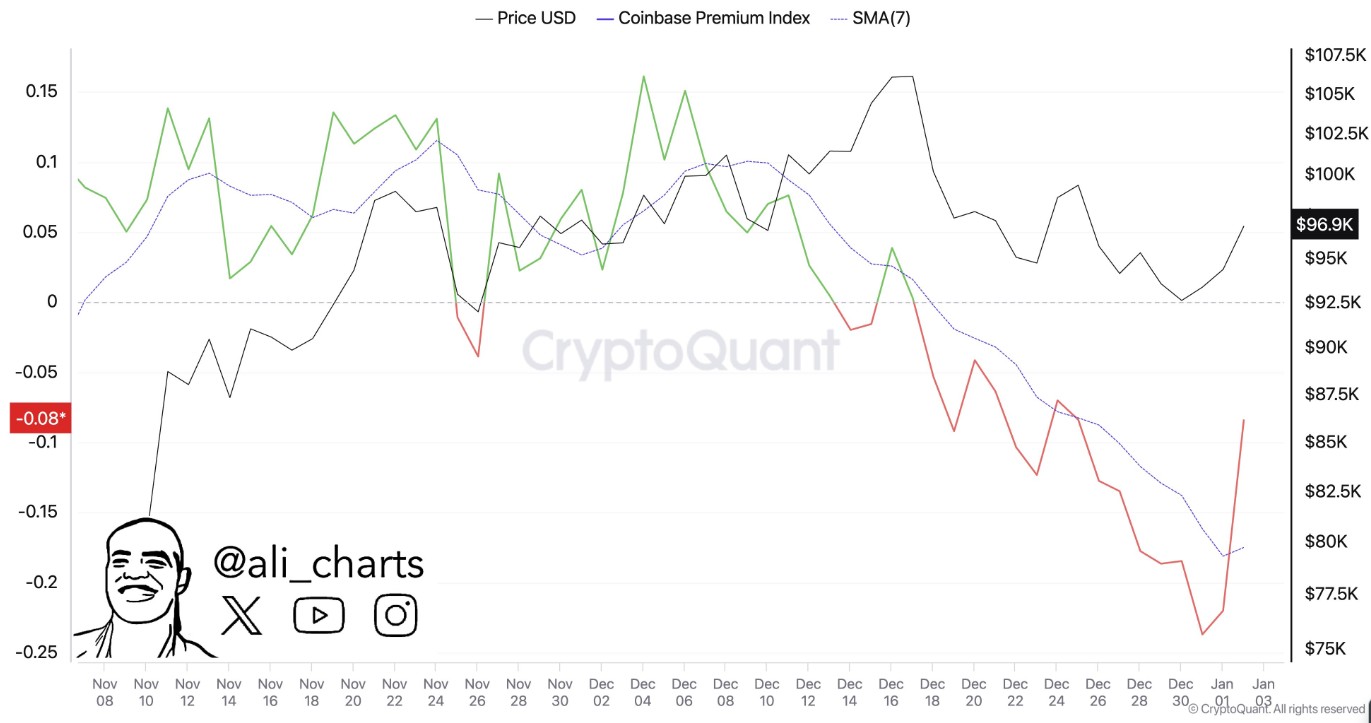

Bitcoin Worth Surges Amid Coinbase Premium Index Low

One of many important indicators mentioned by Martinez is the Coinbase Premium Index, which lately hit -0.23%, its lowest level in two years. This index measures the value distinction between Bitcoin on Coinbase and different exchanges.

A damaging premium means that US-based buyers could also be much less prepared to pay a premium for Bitcoin, however the present rebound may point out a shift towards rising institutional curiosity within the asset.

Martinez additionally famous that the latest uptick within the Bitcoin worth comes amid a notable withdrawal pattern, with over 48,000 BTC—valued at greater than $4.5 billion—pulled from exchanges previously week. This pattern signifies a bullish sentiment amongst buyers, regardless of a quick worth correction that occurred late final yr.

Regardless of these optimistic alerts, Martinez cautions that Bitcoin is at an important juncture. He emphasised the significance of sustaining an in depth above the 50-day transferring common (MA), at present simply above $96,000.

A failure to keep up this stage may result in a possible downward correction. Conversely, a sustained shut above the 50-day MA may sign the top of the latest correction and ensure a extra sturdy bullish pattern.

Sturdy Upward Transfer Anticipated After Wave Three Breakout

Along with Martinez’s insights, the Elliot Wave Academy has supplied a technical evaluation of the latest Bitcoin worth actions, suggesting that the cryptocurrency is at present within the fourth wave of a bigger bullish cycle.

The academy’s evaluation signifies that after a strong breakout from a worth channel, Bitcoin has efficiently surpassed the best stage of wave three, which can sign a robust upward transfer. The fourth wave, in accordance with their evaluation, is characterised by a sideways sample following the sharp rise of wave three.

The potential correction zones for this wave have been recognized, and may these ranges be breached, the following upward wave may goal a Bitcoin worth vary between $117,475.70 and $138,058.37. These figures symbolize main bullish targets that might entice additional funding and drive Bitcoin’s worth greater.

Throughout, because the Bitcoin worth continues its upward trajectory, the mix of serious withdrawals from exchanges, a low Coinbase Premium Index, and optimistic Elliott Wave evaluation paints a compelling image for the cryptocurrency’s future.

Nonetheless, buyers ought to stay vigilant, keeping track of crucial worth ranges that might decide the market’s subsequent transfer.

On the time of writing, the market’s main crypto is buying and selling at $98,320.

Featured picture from DALL-E, chart from TradingView.com