Ethereum worth declined to a crucial assist stage as cryptocurrencies skilled a pointy pullback following the Federal Reserve’s hawkish rate of interest announcement.

Ethereum (ETH) slipped to $3,540, marking a ten% drop from its peak earlier this week. This retreat coincided with the sell-off of different cash like Bitcoin (BTC) and Solana (SOL).

Regardless of the value drop, Ethereum’s fundamentals stay robust. Notably, Ethereum Alternate-Traded Funds have seen regular inflows, now totaling over $2.46 billion. These inflows have elevated for 18 consecutive days, reflecting rising curiosity from buyers.

Ethereum ETFs are gaining traction as buyers anticipate the SEC could quickly permit staking inside these funds. At the moment, the absence of staking choices has seemingly deterred some institutional buyers from absolutely embracing these ETFs

Funds by firms like Grayscale, Blackrock, Constancy, Bitwise, and VanEck are the most important holders of Ethereum.

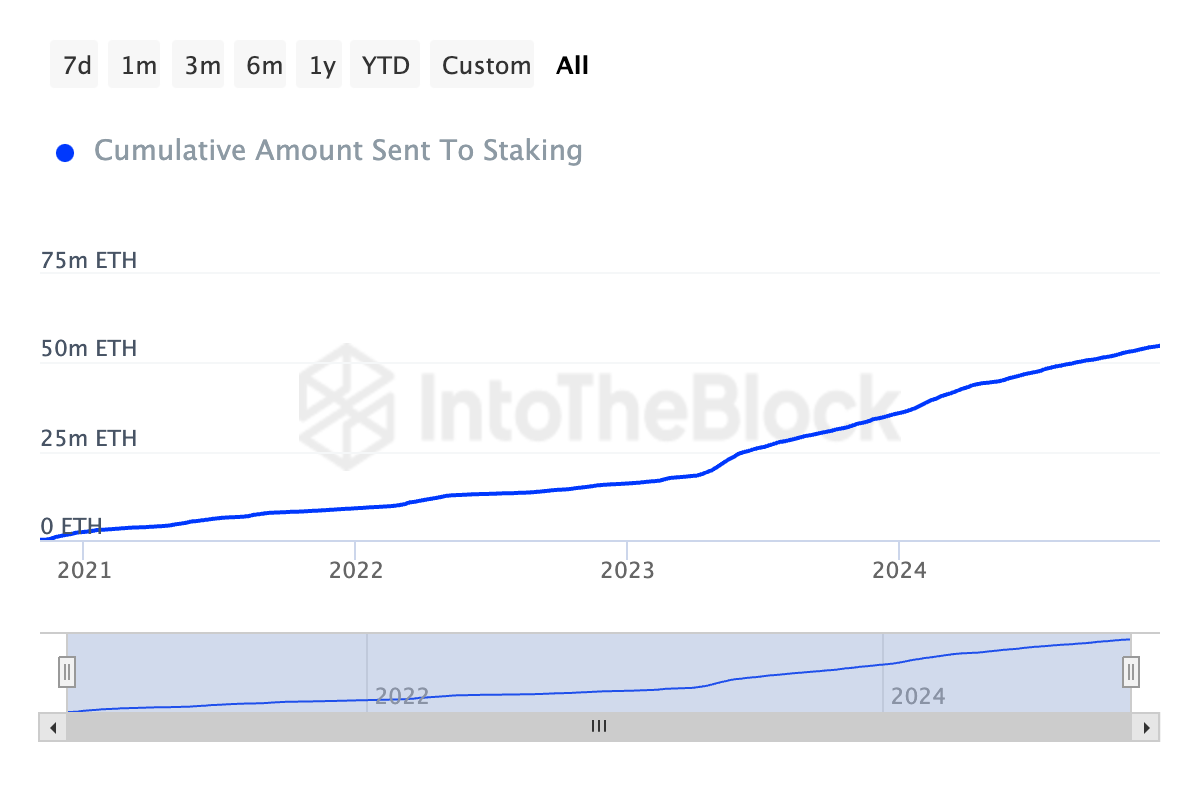

In the meantime, the variety of staked ETH cash has continued rising. There are actually over 54.7 million ETH tokens, are actually staked, supported by a rising base of greater than 206,000 distinctive stakers. This pattern underscores long-term bullish sentiment amongst buyers who plan to carry their ETH positions.

Cumulative ETH despatched to staking | Supply: IntoTheBlock

Ethereum continues to be the most important participant within the blockchain trade, with the full worth locked in its Decentralized Finance ecosystem rising to over $73.7 billion. These funds are a lot greater than most different chains like Solana, Base, and Arbitrum, mixed.

ETH retreated after the Federal Reserve slashed rates of interest and maintained a hawkish tone. It now expects to chop charges two instances as an alternative of 4 in 2025. Cryptocurrencies and different dangerous property do properly when the Fed has embraced a dovish tone.

You may also like: Ki Younger Ju: South Korea’s financial disaster might drive crypto companies abroad

Ethereum worth evaluation

ETH worth chart | Supply: crypto.information

The day by day ETH chart reveals a pointy reversal after the value reached $4,090, a crucial resistance stage. This stage corresponds to the December 6 and March 11 highs, in addition to the acute overshoot stage on the Murrey Math Traces.

Ethereum has fashioned a bearish double-top sample at this resistance, with its neckline positioned at $3,526. This sample alerts potential additional declines, with ETH presumably testing the key assist and resistance pivot level at $3,125. Extra good points can be confirmed if Ethereum rises above the resistance stage at $4,090.

You may also like: HODL Day in crypto: How a typo turned a celebration