Earlier than Federal Reserve Chair Jerome Powell introduced a 25 foundation level (bps) rate of interest minimize, Ethereum (ETH) holders have been optimistic that the occasion would gas a rally towards $4,500. Nevertheless, the speed minimize didn’t yield the anticipated bullish final result, with ETH experiencing a 4.50% decline shortly afterward.

This drop has diminished hopes for a notable breakout, elevating questions on what could possibly be subsequent for Ethereum.

Ethereum Adjustments It Response In comparison with Final Charge Lower

Some months again, the Fed minimize rates of interest by 50 bps. This improvement drove a notable rally in crypto costs, together with Ethereum. At the moment, the sentiment leaned towards expectations of an identical fee minimize earlier than the yr ended. Nevertheless, this didn’t materialize.

Following yesterday’s choice, ETH’s worth dropped from $3,890 to $3,624. Whereas the cryptocurrency has recovered barely, a number of on-chain indicators reveal that the tried rebound could possibly be a fakeout.

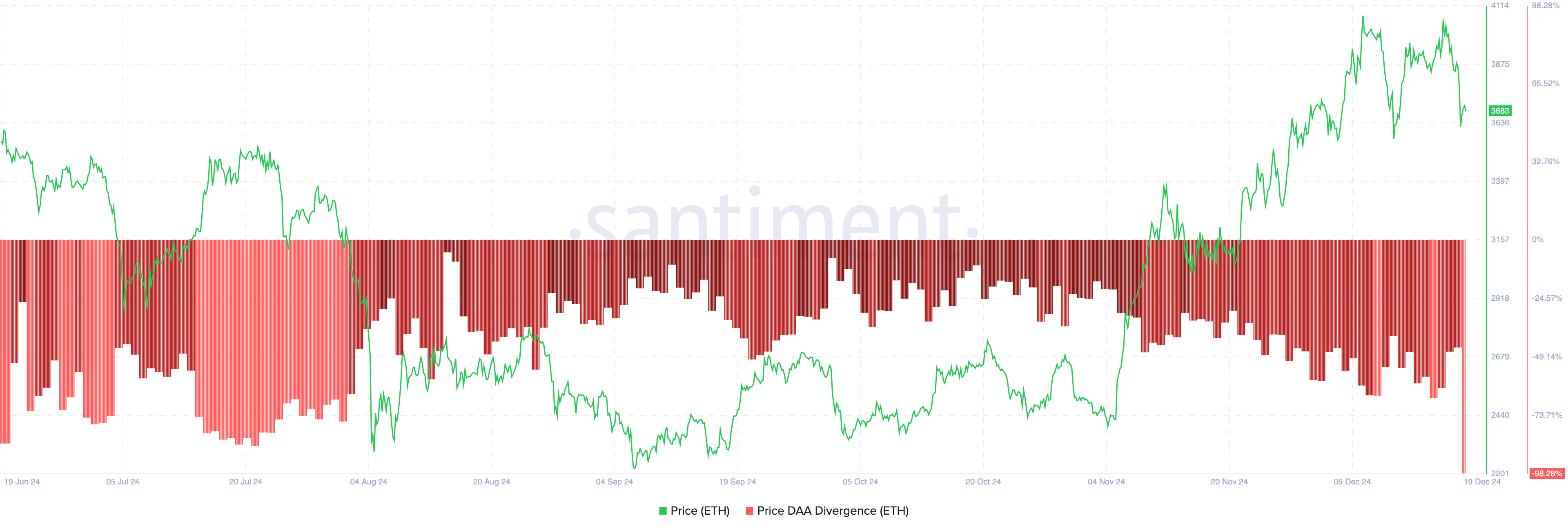

One of many indicators suggesting such is the price-Every day Lively Addresses (DAA) divergence. The value DAA divergence checks if the consumer participation is rising alongside the worth. When it’s optimistic, it means engagement with the cryptocurrency has elevated and is bullish for thhe worth.

Ethereum Worth DAA Divergence. Supply: Santiment

On the flip facet, a unfavorable score signifies fewer interactions, which is bearish. In accordance with Santiment, Ethereum’s worth DAA divergence has declined to -98.28%, indicating decrease consumer participation. Ought to this pattern proceed, ETH’s worth might face a steeper worth lower.

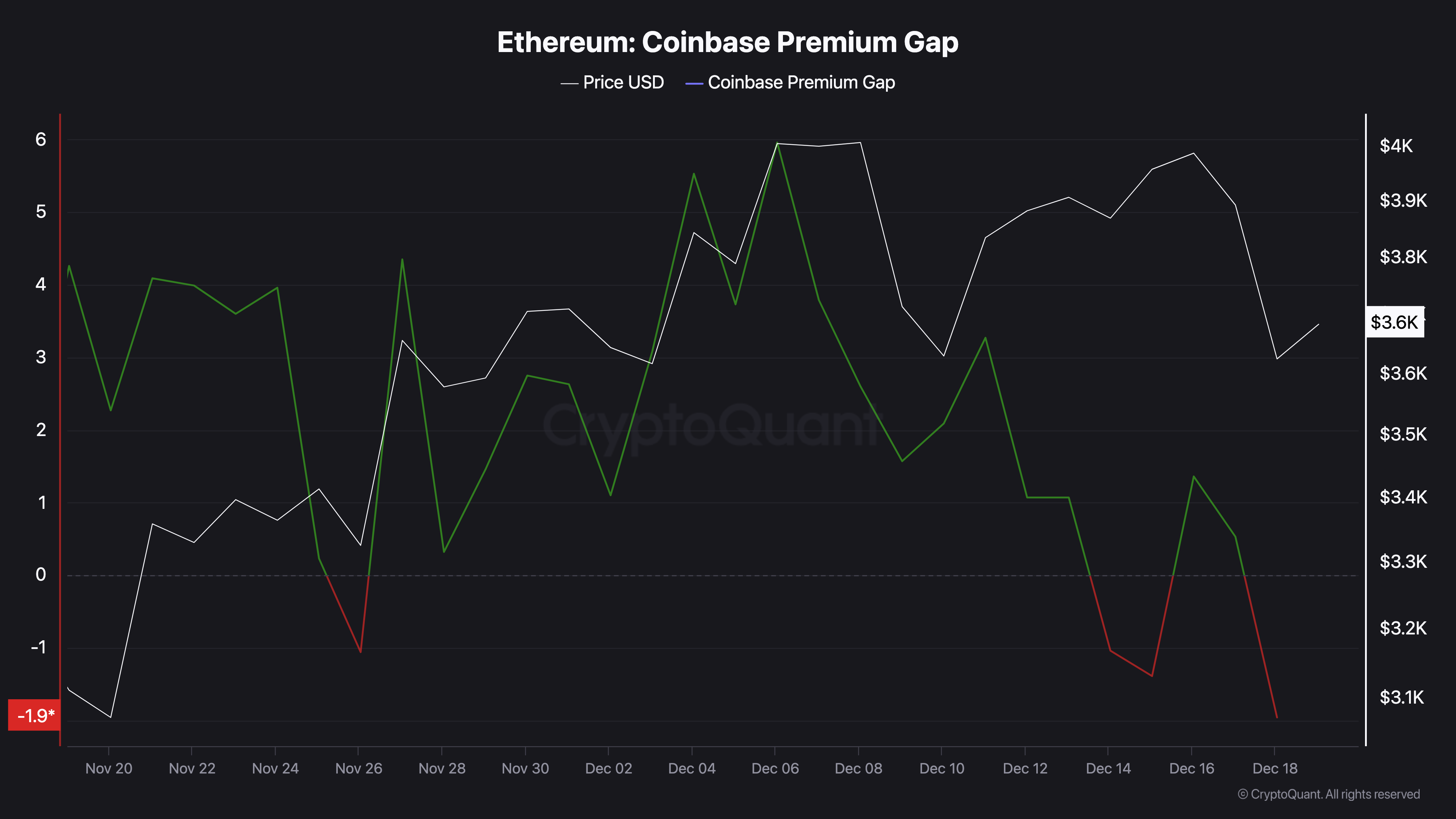

Along with the metric above, the Coinbase Premium Hole is one other indicator that helps an extra ETH decline. This metric measures the worth distinction between the Coinbase ETH/USD pair and the identical pair on Binance.

When there’s a excessive premiumworth on Coinbase relative to Binance, it indicators notable shopping for exercise amongst US-based traders. This shopping for stress could come from heightened demand throughout the area and favors a worth uptick.

Ethereum Coinbase Premium Hole. Supply: CryptoQuant

Conversely, when the worth on Coinbase lags behind Binance, it’d recommend a relative cooling of demand within the US market or stronger promoting stress from institutional or retail traders.

The chart above exhibits that the premium hole has fallen to -1.96, indicating important promoting stress for ETH following the Fed fee minimize.

ETH Worth Prediction: Not But the Season for $4,500

Past ETH Fed fee minimize response, it skilled a decline as a result of formation of a head-and-shoulders sample on the 4-hour chart. A head-and-shoulders sample is a basic technical evaluation chart formation that indicators a possible pattern reversal from bullish to bearish.

The sample incorporates a worth rise (left shoulder), adopted by a peak (head), after which a decline (proper shoulder). When the worth breaks beneath the neckline after forming the suitable shoulder, it indicators a bearish pattern reversal.

Nevertheless, the sample’s reliability is dependent upon the buying and selling quantity. As seen beneath, the quantity round ETH has decreased, and the worth has damaged beneath the neckline.

Ethereum 4-Hour Evaluation. Supply: TradingView

Ought to this stay the identical, then the ETH worth would possibly drop to $3,501. Nevertheless, if quantity will increase alongside shopping for stress, this prediction won’t come to move. As an alternative, Ethereum’s worth would possibly rise to 4,109 and ultimately towards $4,500.