Ethereum is displaying robust bullish momentum, pushed by an inflow of consumers. Nevertheless, as the value nears a major resistance degree at $4K, market contributors ought to anticipate a interval of consolidation with the potential for heightened volatility.

Technical Evaluation

By Shayan

The Weekly Chart

Ethereum has skilled an impulsive uptrend, fueled by shopping for exercise close to the $2.5K help area. This motion has led to a breakout above the important thing 100-day and 200-day transferring averages, signaling a shift in market sentiment and confirming the consumers’ dominance. The asset is approaching the $4K resistance zone, a vital psychological and technical degree, doubtless full of substantial provide.

The $4K threshold is a possible distribution zone for long-term holders seeking to take earnings. A consolidation part round this degree will doubtless give the market time to soak up promoting stress. Nevertheless, a liquidity pool above $4K might set off a brief squeeze if breached, doubtlessly driving Ethereum towards its all-time excessive of $4.9K.

The 4-Hour Chart

On the 4-hour timeframe, ETHs worth motion displays a Wyckoff accumulation sample inside the $2K-$2.8K vary, culminating in a breakout and an impulsive rally previous the $3.5K decisive threshold. The asset has additionally damaged above the higher boundary of a bearish wedge sample, a bullish sign, and has since accomplished a pullback.

If this correction holds and shopping for stress continues, Ethereum will doubtless prolong its uptrend towards the $4K resistance. Nevertheless, warning is warranted, as a bearish divergence between the RSI indicator and the value suggests a waning bullish momentum. This divergence signifies that the market might face a interval of consolidation earlier than figuring out its subsequent important transfer.

Onchain Evaluation

By Shayan

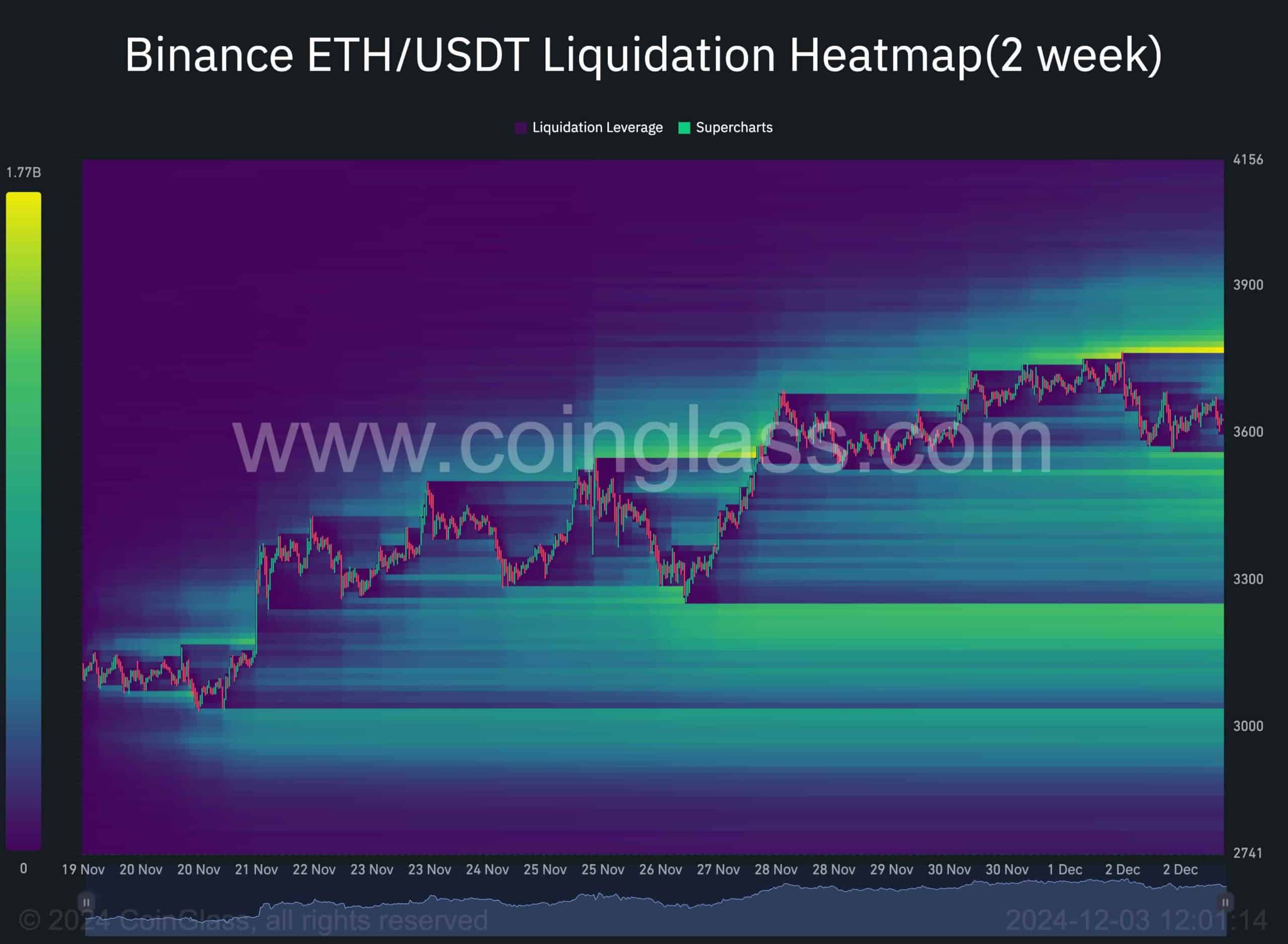

The conduct noticed in Ethereum’s worth motion, notably the failure to drop beneath the $3.3K degree, aligns with important liquidity beneath that time, as seen within the Binance liquidation heatmap. This liquidity doubtless consists of stop-loss orders and liquidation costs for big merchants, or whales, who actively defend their positions to forestall a cascade of liquidations.

Equally, the $4K degree is one other vital juncture with substantial liquidity, doubtless tied to quick positions established in anticipation of resistance. Ought to the asset breach the $4K degree, these shorts could also be pressured to cowl their positions, triggering a short-liquidation cascade. This might result in an impulsive surge, as these positions are unwound, and the market shortly strikes increased.