Bitcoin (BTC) continues to cement its place as a dominant asset within the world monetary panorama, attaining a historic milestone this week.

In response to the most recent Bitfinex Alpha Market Report, BTC’s market capitalization has surpassed that of silver, reaching an all-time excessive (ATH) of $1.856 trillion.

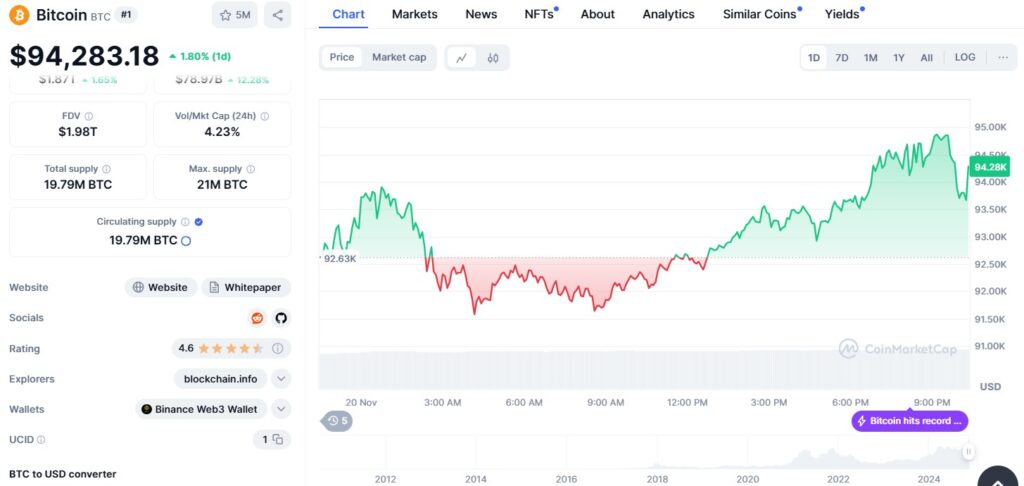

This achievement follows a formidable worth rally that noticed BTC climb to $94,309.46, marking its second ATH inside a single week.

The surge underscores the rising inflow of institutional funding in digital property, elevating Bitcoin’s standing among the many world’s largest traded property.

Supply: CoinMarketCap

BTC surges previous silver in market worth

Bitcoin’s market capitalization leapfrogged silver’s $1.762 trillion, positioning it because the seventh most precious asset globally, as reported by Infinite MarketCap.

The latest motion additionally highlights the substantial quantity of capital flowing into Bitcoin.

In January 2021, Bitcoin’s market capitalization stood at $450 billion.

The exponential development since then indicators a dramatic rise in market participation, pushed by institutional gamers in search of publicity to digital property.

With Bitcoin’s market capitalization now exceeding silver, the main focus shifts as to whether BTC might quickly rival gold exchange-traded funds (ETFs).

Gold stays the dominant world asset with a staggering market capitalization of $17.686 trillion.

Bitcoin’s latest tempo means that it might surpass the property beneath administration (AUM) of gold ETFs throughout the subsequent two months.

This accelerated trajectory underscores the maturation of Bitcoin as an asset class.

The cryptocurrency’s means to draw vital capital inflows in a compressed timeframe showcases its rising acceptance amongst conventional monetary establishments.

As a hedge towards inflation and an alternate retailer of worth, Bitcoin continues to realize traction amongst a various vary of traders.

Institutional cash drives record-breaking rally

The present Bitcoin rally stands out as a result of scale of institutional involvement.

Analysts have famous that shifting Bitcoin’s worth now requires considerably extra capital in comparison with its earlier rallies.

The latest ATHs, achieved inside hours of one another, replicate unprecedented ranges of funding exercise.

Market individuals are more and more drawn to Bitcoin’s long-term worth proposition, significantly as conventional property face financial uncertainty.

Institutional adoption is additional bolstered by elevated regulatory readability and the launch of Bitcoin ETFs in main markets, which give extra accessible funding avenues.

Bitcoin’s rising dominance amongst world property

Bitcoin’s rise to the seventh place in world asset rankings marks a pivotal second within the cryptocurrency’s evolution.

It now outpaces legacy property comparable to silver and is narrowing the hole with know-how and monetary giants.

BTC’s market capitalization of $1.856 trillion underscores its transition from a speculative digital foreign money to a acknowledged monetary instrument.

Regardless of its achievements, Bitcoin faces challenges, together with worth volatility and regulatory scrutiny. Its resilience and constant development over time proceed to draw each retail and institutional traders.

The query now could be whether or not Bitcoin can maintain its present momentum.

With macroeconomic components comparable to inflation and financial coverage enjoying a essential function, BTC’s efficiency might hinge on broader market situations.

However, its established place as a digital asset chief makes it well-poised for additional development.

As Bitcoin climbs the worldwide asset rankings, its function in shaping the way forward for finance turns into more and more evident.

The cryptocurrency’s means to constantly outperform conventional property indicators a shift in investor preferences, cementing its place in trendy portfolios.

The publish Bitcoin overtakes silver as seventh largest asset after hitting $94k ATH appeared first on Invezz